简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Lunar Capital Review: Is This Broker Legit?

Abstract:Lunar Capital is an unregulated UK broker offering forex, stocks, indices, and crypto. Learn about risks and trading features in this review.

Lunar Capital presents as a multi‑asset CFD broker targeting retail traders with high leverage and a slick web platform, but the core facts point to elevated risk and an absence of regulatory oversight. The firm is unregulated, lists a UK association without FCA authorization, and promotes leverage up to 1:200, paired with a minimum deposit of 500, which places novice capital at disproportionate risk.

Lunar Capital Review: Key Findings

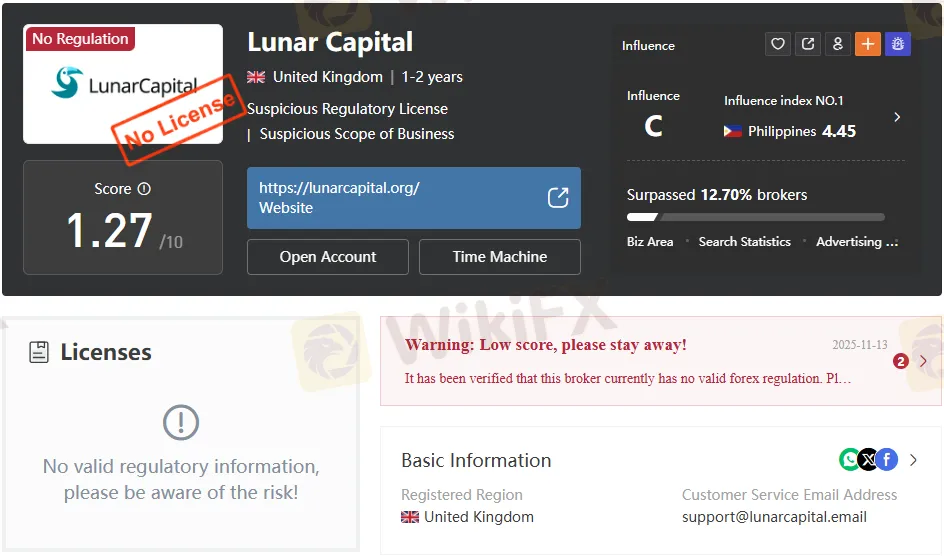

Lunar Capital operates without any recognized forex regulation and explicitly shows “No regulation,” while signaling a UK linkage that is not backed by FCA permissions; this combination is a red flag for consumer protection and recourse. The brokers score noted in the document is low (1.27/10), with a warning to stay away due to a lack of valid licensing, which aligns with the risk profile of offshore, lightly governed operations. The offering spans forex, indices, stocks, commodities, and cryptocurrencies via the proprietary XCritical web platform and mobile app, but does not provide MT4/MT5 or a demo account, limiting transparency and testing for new users.

Is Lunar Capital Regulated?

No—Lunar Capital is not regulated “No regulation” and “No valid regulatory information,” and that it does not hold FCA authorization despite indicating a UK connection. Absence of authorization means client money safeguards, negative balance protection, and dispute resolution standards typical of tier‑1 regimes are not assured. The document also flags a “Suspicious Regulatory License” status and advises caution, reinforcing consumer risk concerns.

Lunar Capital Regulation: Facts and Signals

The material shows registration or association with the United Kingdom but explicitly clarifies that there is no FCA license and no valid forex regulation in place. The brokers risk indicators include a low trust score (1.27/10), “Suspicious Scope of Business,” and a notice to stay away—signals commonly tied to unlicensed sales targeting global retail flows. Domain data lists lunarcapital.org registered on 2023‑04‑03, updated 2025‑03‑09, and using Cloudflare nameservers; operational timelines under two years increase the need for due diligence.

Lunar Capital Broker Review: Fees, Accounts, Platform

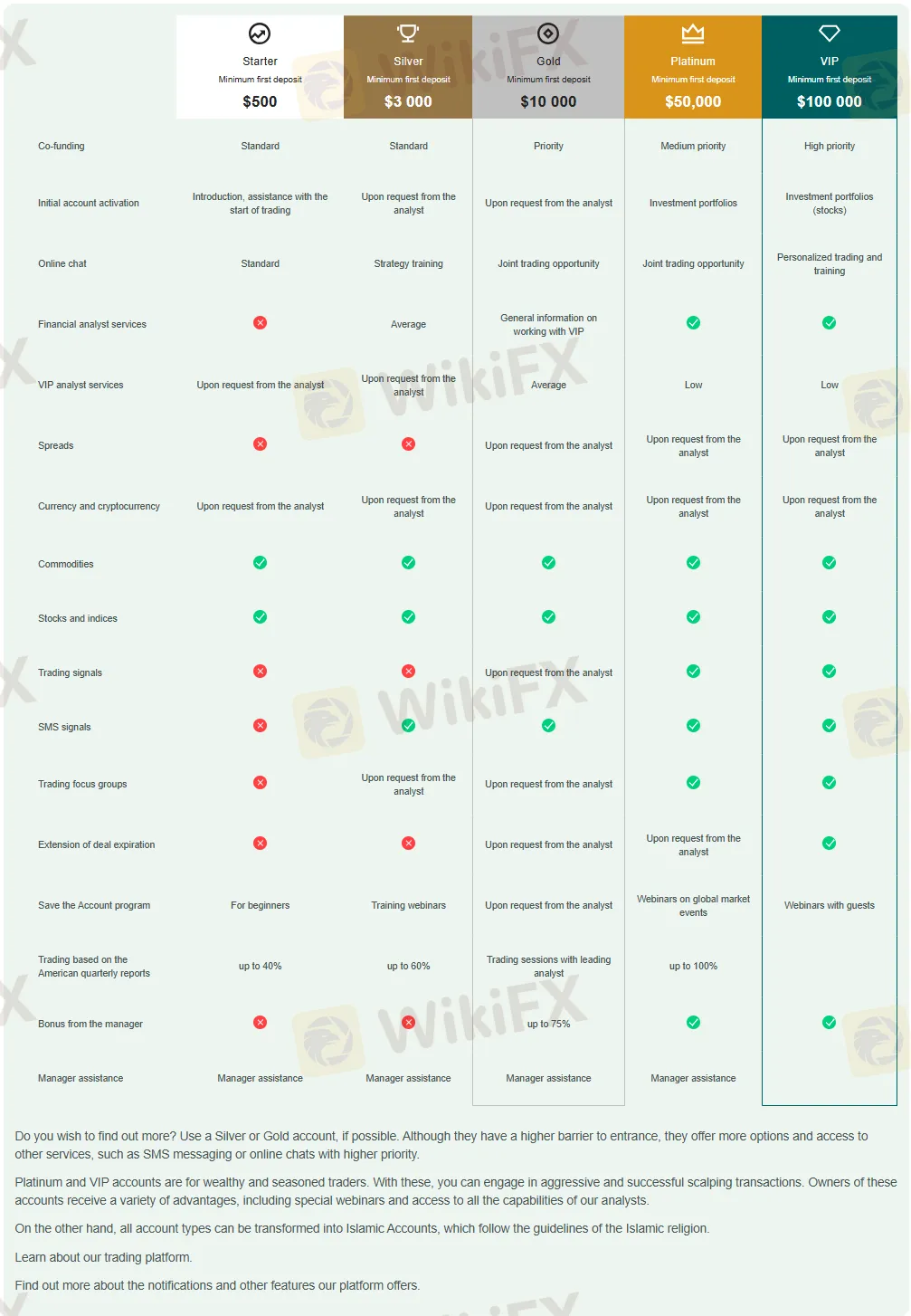

Account tiers include Starter, Silver, Gold, Platinum, and VIP, each with higher minimums, starting from a minimum deposit of 500 stated in the summary; leverage is advertised “up to 1:200,” which can amplify both profits and losses substantially. The spreads disclosed for major and minor FX pairs are generally wider than typical FCA‑regulated competitors, with examples such as AUDUSD listed thinning from 2.7 down to 1.2 at higher tiers, still above the sub‑1.0 pip benchmarks many regulated brokers quote on top‑tier accounts. Platform availability is limited to XCritical (web and mobile); MT4/MT5 are not supported, and a demo account is marked X, making pre‑funding testing difficult for prospective clients.

Lunar Capital FCA License and Domain Details

The broker has no FCA approval and reiterates “No License” despite the UK linkage, a critical point for any trader who prioritizes client fund segregation and recourse mechanisms. Domain information shows lunarcapital.org was created on 2023‑04‑03, status client‑transfer‑prohibited, and expiry of 2026‑04‑03, which is consistent with a relatively new brand lifecycle. Contact lines in the document include a UK phone number, a support email using “lunarcapital.email,” and a Skype handle, but such details do not substitute for formal authorization.

Pros and Cons

- Pros: Multi‑asset lineup across FX, indices, stocks, commodities, and crypto; several account tiers; supports Visa, MasterCard, Neteller, and Skrill; web and mobile access via XCritical.

- Cons: No regulation and no FCA authorization; no MT4/MT5; no demo account; higher‑than‑average spreads; minimum deposit from 500; low trust score with explicit risk warnings.

At‑a‑glance Comparison

| Feature | Lunar Capital | Typical FCA‑regulated broker |

| Authorization | No regulation; no FCA license. | FCA authorization with capital, segregation, and conduct requirements. |

| Leverage | Up to 1:200. | Retail capped at ≤1:30\leq 1:30≤1:30 under FCA/ESMA. |

| Platforms | XCritical web/mobile only; no MT4/MT5. | MT4/MT5, cTrader, or proprietary with audited infrastructure. |

| Demo Account | Not available (marked X). | Standard; demo and paper trading expected. |

| Spreads | EURUSD cited at about 2 pips on Standard; other pairs show tiered but elevated spreads. | Often sub‑1.0 pip on top tiers with transparent commission models. |

| Minimum Deposit | 500 minimum cited in summary. | From 0–250 typical; tiered funding with strict onboarding. |

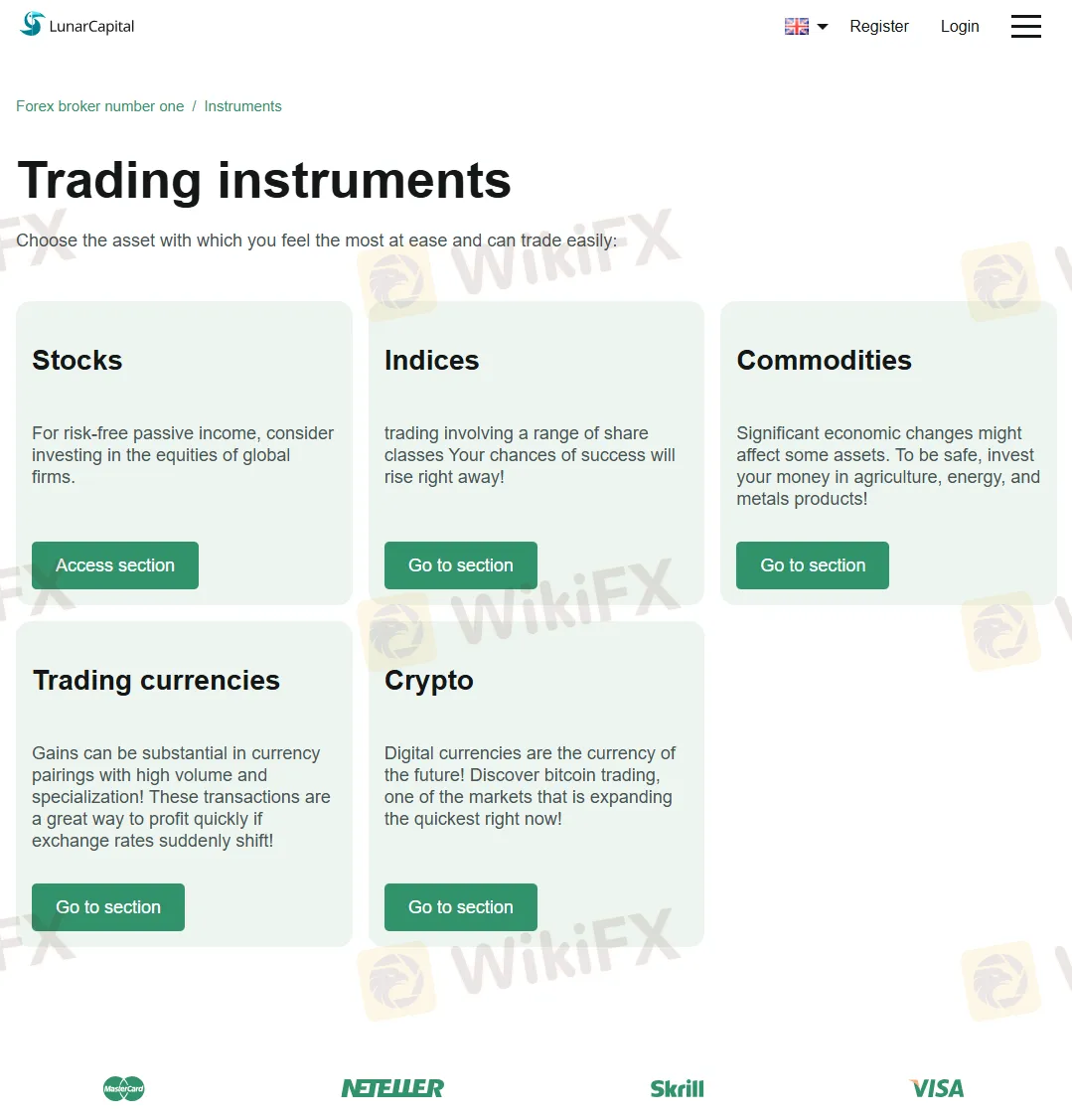

Trading Instruments and Access

- Instruments: Forex, indices, stocks, commodities, cryptocurrencies; bonds/options/ETFs marked as unsupported.

- Platforms: XCritical web platform and mobile app on iOS/Android; positioning suggests ease of access but fewer third‑party integrations.

- Payments: Visa, MasterCard, Neteller, Skrill; the document claims no deposit/withdrawal fees from the broker side, though processor fees can still apply externally.

Risk and Suitability

- High leverage to 1:200 increases liquidation probability in volatile instruments; with wider spreads and no demo, real‑money testing risk escalates.

- Unregulated status removes formal complaint channels, compensation schemes, and mandated disclosures required under FCA or similar tier‑1 bodies.

- The UK phone and branding signals do not compensate for absent authorization; jurisdictional claims should be verified before any funding.

Actionable Guidance for Traders

- If prioritizing safety, consider an FCA‑regulated broker with negative balance protection, audited financials, and leverage limits aligned with retail protections.

- If evaluating Lunar Capital despite the risks, limit exposure, avoid large upfront deposits, and independently validate withdrawals with small test amounts before scaling.

- Document all communications and retain payment receipts; lack of regulation often correlates with fragile dispute pathways.

Bottom Line

Given the absence of recognized authorization, the low trust score, and operational constraints such as no demo and no MT4/MT5, Lunar Capital fits a high‑risk profile unsuitable for most retail traders; those requiring formal protections should opt for fully regulated alternatives.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Grand Capital Doesn’t Feel GRAND for Traders with Withdrawal Denials & Long Processing Times

The trading environment does not seem that rosy for traders at Grand Capital, a Seychelles-based forex broker. Traders’ requests for withdrawals are alleged to be in the review process for months, making them frustrated and helpless. Despite meeting the guidelines, traders find it hard to withdraw funds, as suggested by their complaints online. What’s also troubling traders are long processing times concerning Grand Capital withdrawals. In this Grand Capital review segment, we have shared some complaints for you to look at. Read on!

EmiraX Markets Withdrawal Issues Exposed

EmiraX Markets Review reveals unregulated status, fake license claims, and withdrawal issues. Stay safe and avoid this broker.

ADSS Review: Traders Say NO to Trading B’coz of Withdrawal Blocks, Account Freeze & Trade Issues

Does ADSS give you plenty of excuses to deny you access to withdrawals? Is your withdrawal request pending for months or years? Do you witness account freezes from the United Arab Emirates-based forex broker? Do you struggle to open and close your forex positions on the ADSS app? Does the customer support service fail to respond to your trading queries? All these issues have become a rage online. In this ADSS Broker review article, we have highlighted actual trader wordings on these issues. Keep reading!

INGOT Brokers Regulation 2025: ASIC vs Offshore License - What Traders Must Know

Explore INGOT Brokers regulation in 2025: Compare their ASIC and Seychelles FSA licenses, understand trader protection levels, and learn about potential risks in this detailed guide.

WikiFX Broker

Latest News

Mitrade Arabic Platform Targets MENA Gold Trading Boom

Israeli Arrested in Rome Over €50M Forex Scam

New FCA Consumer Alert 2025: Important Warning for All Consumers

EmiraX Markets Withdrawal Issues Exposed

2 Malaysians Arrested in $1 Million Gold Scam Impersonating Singapore Officials

Exness Broker Expands in South Africa with Cape Town Hub

Fraud Mastermind Zhimin Qian Sentenced to 11 Years for $6.6 Billion Bitcoin Ponzi Scheme

Is FXPesa Regulated? Real User Reviews & Regulation Check

Almahfaza Broker – 2025 Review: Safe or Scam?

Uniglobe Markets Review 2025: A Complete Guide to an Unregulated Broker

Currency Calculator