简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

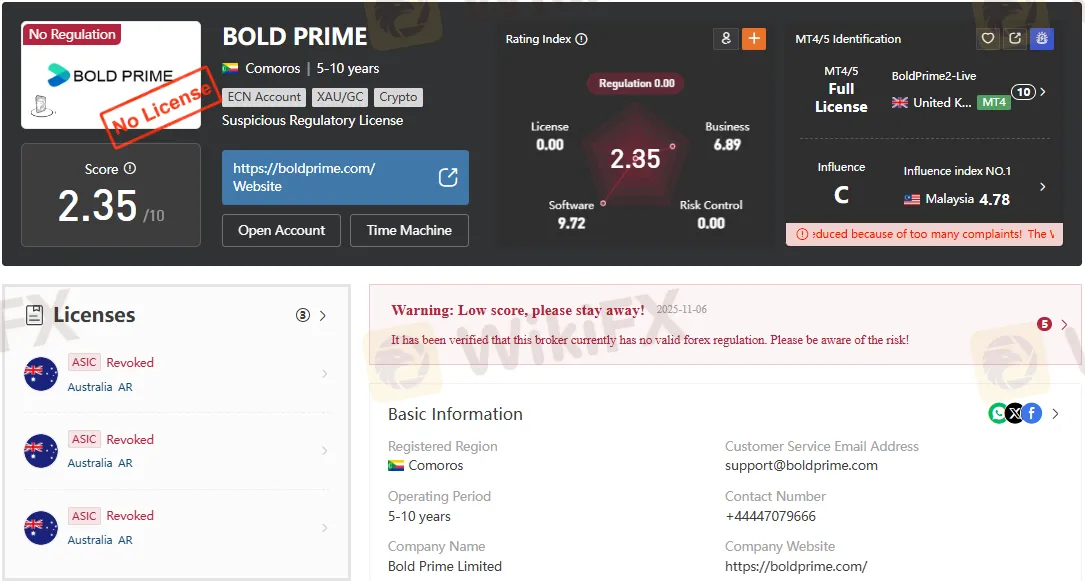

Bold Prime Regulation: Is There Really A License?

Abstract:Bold Prime Regulation Review: ASIC license revoked. Learn the risks of trading with unregulated brokers and why oversight matters.

Introduction

Bold Prime, once tied to Australia‘s Securities and Investments Commission (ASIC), has seen its regulatory standing collapse. Regulation is the invisible shield protecting traders in the volatile world of forex and CFDs. Without it, investors are exposed to unnecessary risks. This review explores the broker’s licensing journey, its current status, and what traders should know before engaging with it.

Bold Primes Background

Bold Prime Pty Ltd entered the market with ambitions of becoming a global broker. To establish credibility, it operated as an Appointed Representative (AR) under STAR FUNDS MANAGEMENT PTY LTD.

This structure allowed Bold Prime to market itself as regulated in Australia, but the distinction matters. An Appointed Representative does not hold a direct license—it operates under another firms authorization. For traders, this means oversight is indirect and weaker compared to brokers with full ASIC licenses.

For years, Bold Prime leaned on this framework:

- License No. 488828 (Bold Prime Pty Ltd)

- License No. 001305306 (Appointed Representative under STAR FUNDS MANAGEMENT PTY LTD)

- Effective Date: March 14, 2017

- Revocation Date: August 17, 2023

These details reveal a broker whose regulatory foundation was borrowed rather than earned.

ASIC Oversight Explained

The Australian Securities and Investments Commission (ASIC) is one of the most respected regulators globally. Brokers under ASIC oversight must meet strict standards, including:

- Segregation of client funds

- Capital adequacy requirements

- Regular audits and compliance reporting

- Dispute resolution mechanisms

These safeguards are designed to protect traders from fraud, insolvency, and malpractice.

Bold Prime‘s reliance on an Appointed Representative license meant it was never directly accountable to ASIC. Instead, STAR FUNDS MANAGEMENT carried the responsibility. This indirect relationship left Bold Prime’s compliance weaker than brokers holding full ASIC licenses.

Current Status: Revoked License

On August 17, 2023, Bold Primes appointed representative license was officially revoked.

Key Details:

- Regulatory Jurisdiction: Australia

- Licensor: STAR FUNDS MANAGEMENT PTY LTD

- Status: Revoked

- Address of Licensed Institution: 6C Barellan Ave, Carlingford NSW 2118

Revocation means Bold Prime no longer has the legal right to claim ASIC oversight. For traders, this translates into a loss of protection—no audits, no dispute resolution, no safety net.

Implications for Traders

The consequences of losing ASIC oversight are far‑reaching:

- Investor Protection Vanishes – Without ASIC, traders lose access to compensation schemes and complaint channels.

- Transparency Becomes Questionable – Revocation often signals compliance failures or a deliberate retreat from regulatory scrutiny.

- Reputation Suffers – In competitive markets, credibility is currency. A revoked license is a red flag that traders cannot ignore.

Independent review platforms echo this sentiment, warning traders against using brokers that are not regulated by top‑tier authorities.

Comparative Analysis: Bold Prime vs. Regulated Brokers

| License Status | Revoked | Active |

| Investor Protection | None | Strong |

| Oversight | Absent | Continuous |

| Credibility | Questioned | Established |

This comparison highlights the gulf between Bold Primes current standing and brokers maintaining active ASIC licenses.

Why Regulation Matters

Regulation is more than a legal requirement—it is the backbone of trust in financial markets. Traders rely on regulators to enforce standards that prevent fraud, mismanagement, and abuse.

When a license is revoked, confidence evaporates. Traders are left to rely on the broker‘s word rather than the regulator’s oversight. Thats a gamble few investors can afford.

Conclusion

Bold Primes license revocation in August 2023 highlights the risks traders face with unregulated brokers. Losing ASIC oversight means no investor protection or dispute resolution.

Traders must always check a brokers current regulatory status before investing. Active licenses from top regulators like ASIC, FCA, or CySEC ensure transparency and security.

Bold Primes revoked license is a clear warning. For safety and trust, choose brokers with valid, reputable regulatory credentials.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Maven Trading Review: Traders Flag Funding Rule Issues, Stop-Loss Glitches & Wide Spreads

Are you facing funding issues with Maven Trading, a UK-based prop trading firm? Do you find Mavin trading rules concerning stop-loss and other aspects strange and loss-making? Does the funding program access come with higher spreads? Does the trading data offered on the Maven Trading login differ from what’s available on the popular TradingView platform? These are some specific issues concerning traders at Maven Trading. Upset by these untoward financial incidents, some traders shared complaints while sharing the Maven Trading Review. We have shared some of their complaints in this article. Take a look.

BTSE Review: Ponzi Scam, KYC Verification Hassles & Account Blocks Hit Traders Hard

Have you lost your capital with BTSE’s Ponzi scam? Did the forex broker onboard you by promising no KYC verification on both deposits and withdrawals, only to be proven wrong in real time? Have you been facing account blocks by the Virgin Islands-based forex broker? These complaints have become usual with traders at BTSE Exchange. In this BTSE review article, we have shared some of these complaints for you to look at. Read on!

Amillex Global Secures ASIC Licence for Expansion

Amillex Global gains ASIC AFSL licence, boosting FX and CFDs credibility. Expansion targets Asia, Australia, and institutional trading growth.

Inzo Broker Review 2025: Is It Legit or a High-Risk Gamble?

When you ask, "Is inzo broker legit?" you want a clear, straight answer before putting your money at risk. The truth about Inzo Broker is complicated. Finding out if it's legitimate means looking carefully at its rules, trading setup, and most importantly, the real experiences of traders who have used it. The broker shows a mixed picture - it has official paperwork from an offshore regulator, but it also has many user warnings about how it operates. This review gives you a fair and fact-based investigation. We will break down all the information we can find, from company records to serious user complaints, so you can make your own clear decision.

WikiFX Broker

Latest News

Forex Expert Recruitment Event – Sharing Insights, Building Rewards

Admirals Cancels UAE License as Part of Global Restructuring

Moomoo Singapore Opens Investor Boutiques to Strengthen Community

OmegaPro Review: Traders Flood Comment Sections with Withdrawal Denials & Scam Complaints

An Unbiased Review of INZO Broker for Indian Traders: What You Must Know

Is Fyntura a Regulated Broker? A Complete 2025 Broker Review

PINAKINE Broker India Review 2025: A Complete Guide to Safety and Services

Is Inzo Broker Safe or a Scam? An Evidence-Based Analysis for Traders

Is Uniglobe Markets Legit? A 2025 Simple Guide to Its Safety, Services, and User Warnings

Is Forex Zone Trading Regulated and Licensed?

Currency Calculator