简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Trading Oscillators: The Secret Tool Every Trader Should Know

Abstract:If you’ve ever looked at a trading chart and wondered how traders know when a price is “too high” or “too low,” the answer often lies in trading oscillators. A trading oscillator is a type of technical indicator that helps traders measure the momentum of price movements. In simple terms, it tells you when a currency pair, stock, or commodity might be overbought or oversold — which can signal a potential reversal.

What Are Trading Oscillators?

If youve ever looked at a trading chart and wondered how traders know when a price is “too high” or “too low,” the answer often lies in trading oscillators.

A trading oscillator is a type of technical indicator that helps traders measure the momentum of price movements. In simple terms, it tells you when a currency pair, stock, or commodity might be overbought or oversold — which can signal a potential reversal.

Oscillators “oscillate” (move back and forth) between two levels, often 0 to 100, helping traders visualize when the market might change direction.

Why Trading Oscillators Matter

For new traders, its easy to get lost in complex charts. But oscillators simplify decision-making by providing clear visual cues.

Here‘s why they’re useful:

- They help you spot trend reversals early.

- They can confirm whether a trend is strong or losing steam.

- They reduce emotional trading by giving objective signals.

When used correctly, trading oscillators can strengthen your trading strategy and improve timing for entry and exit points.

Popular Types of Trading Oscillators

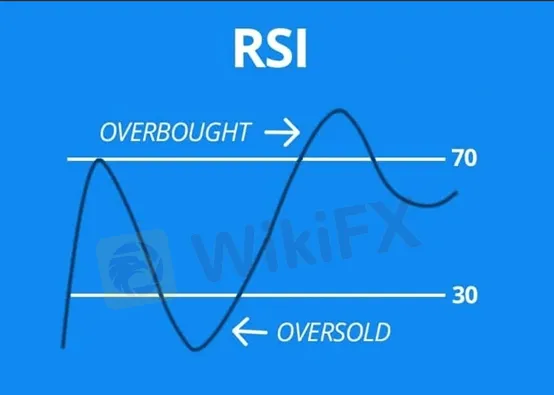

Relative Strength Index (RSI)

The RSI is one of the most popular oscillators. It ranges from 0 to 100:

- Above 70 → the market may be overbought (price could drop soon).

- Below 30 → the market may be oversold (price could rise soon).

RSI helps traders spot momentum shifts before the price reacts.

Moving Average Convergence Divergence (MACD)

The MACD is another widely used momentum trading tool. It shows the relationship between two moving averages of price.

When the MACD line crosses above the signal line, its often a buy signal.

When it crosses below, it can be a sell signal.

MACD works great for confirming the direction of a trend.

Stochastic Oscillator

This oscillator compares a securitys closing price to its price range over a set period. Like RSI, it helps identify overbought and oversold conditions, often using 80 and 20 as thresholds.

How to Use Trading Oscillators Wisely

Combine with trend analysis.

Dont rely only on oscillators — pair them with tools like moving averages to confirm signals.

Avoid false signals.

In a strong trend, oscillators can stay overbought or oversold for a long time. Wait for confirmation before trading.

Adjust settings.

Shorter periods make the oscillator react faster but can cause more noise; longer periods smooth out signals but may delay entry.

Conclusion

Trading oscillators are essential tools for traders who want to understand market momentum without diving into overly complex analysis.

For beginners, learning to read oscillators like RSI, MACD, and Stochastic can make trading decisions clearer and more confident.

Used with a sound trading strategy, these tools can help you time your entries and exits more effectively — and take your trading journey to the next level.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Global Guide to Finding Forex IBs/Brokers — Share Your Pick and Win Big!

Dear forex enthusiasts, are you also troubled by these questions? “In India, can’t find a reliable IB? What should I do?” “With so many brokers, which one offers the lowest spreads and fastest withdrawals?” “Want to connect with local forex enthusiasts but don’t know where to start?” Now, leave these challenges to us! Share your experience and win exciting rewards!

Maven Trading Review: Traders Flag Funding Rule Issues, Stop-Loss Glitches & Wide Spreads

Are you facing funding issues with Maven Trading, a UK-based prop trading firm? Do you find Mavin trading rules concerning stop-loss and other aspects strange and loss-making? Does the funding program access come with higher spreads? Does the trading data offered on the Maven Trading login differ from what’s available on the popular TradingView platform? These are some specific issues concerning traders at Maven Trading. Upset by these untoward financial incidents, some traders shared complaints while sharing the Maven Trading Review. We have shared some of their complaints in this article. Take a look.

BTSE Review: Ponzi Scam, KYC Verification Hassles & Account Blocks Hit Traders Hard

Have you lost your capital with BTSE’s Ponzi scam? Did the forex broker onboard you by promising no KYC verification on both deposits and withdrawals, only to be proven wrong in real time? Have you been facing account blocks by the Virgin Islands-based forex broker? These complaints have become usual with traders at BTSE Exchange. In this BTSE review article, we have shared some of these complaints for you to look at. Read on!

Inzo Broker Review 2025: Is It Legit or a High-Risk Gamble?

When you ask, "Is inzo broker legit?" you want a clear, straight answer before putting your money at risk. The truth about Inzo Broker is complicated. Finding out if it's legitimate means looking carefully at its rules, trading setup, and most importantly, the real experiences of traders who have used it. The broker shows a mixed picture - it has official paperwork from an offshore regulator, but it also has many user warnings about how it operates. This review gives you a fair and fact-based investigation. We will break down all the information we can find, from company records to serious user complaints, so you can make your own clear decision.

WikiFX Broker

Latest News

2 Malaysians Arrested in $1 Million Gold Scam Impersonating Singapore Officials

Moomoo Singapore Opens Investor Boutiques to Strengthen Community

OmegaPro Review: Traders Flood Comment Sections with Withdrawal Denials & Scam Complaints

An Unbiased Review of INZO Broker for Indian Traders: What You Must Know

BotBro’s “30% Return” Scheme Raises New Red Flags Amid Ongoing Fraud Allegations

The 5%ers Review: Is it a Scam or Legit? Find Out from These Trader Comments

WikiEXPO Dubai 2025 Concludes Successfully — Shaping a Transparent, Innovative Future

Admirals Cancels UAE License as Part of Global Restructuring

Forex Expert Recruitment Event – Sharing Insights, Building Rewards

Exness Broker Expands in South Africa with Cape Town Hub

Currency Calculator