简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

NAJM Capital Broker Review: Is it Legit or a Scam?

Abstract:When choosing a forex broker, traders prioritize transparency, reliability, and fund security. A forex broker, named NAJM Capital, recently presents itself as a global trading platform offering access to forex, commodities, indices, and cryptocurrencies. However, with an increasing number of unregulated brokers, the question remains: Is NAJM Capital a legitimate broker or a potential scam?

When choosing a forex broker, traders prioritize transparency, reliability, and fund security. A forex broker, named NAJM Capital, recently presents itself as a global trading platform offering access to forex, commodities, indices, and cryptocurrencies. However, with an increasing number of unregulated brokers, the question remains: Is NAJM Capital a legitimate broker or a potential scam?

About NAJM Capital

NAJM Capital markets itself as a professional trading platform designed for both beginners and experienced traders. It offers several account types with varying deposit requirements and claims to deliver advanced technology and personalized support.

Yet, after investigating the brokers background, regulation, and user feedback, we found out that its transparency is lacking, which is a major red flag for any trading platform handling client funds.

Account Types and Minimum Deposits

NAJM Capital offers four types of trading accounts, each catering to different capital levels:

| Account Type | Minimum Deposit | Target Trader | Features |

| Prestige Account | $50,000 | Professional traders | Premium features, VIP support |

| Premiere Account | $20,000 | Advanced traders | Dedicated account manager |

| Elite Account | $10,000 | Intermediate traders | Access to trading webinars |

| Smart Account | $1,000 | Beginner traders | Basic trading access |

At first glance, this tiered structure seems flexible. However, the high minimum deposits, especially compared to reputable regulated brokers that often start at $50 or less, make NAJM Capital an unusually expensive choice for newcomers.

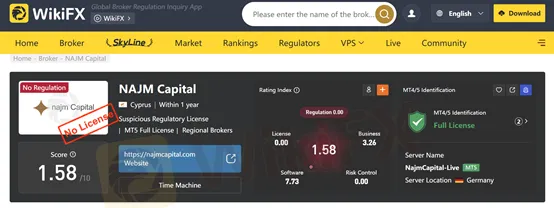

WikiFX Rating and Broker Assessment

According to WikiFX, an authoritative forex broker review platform, NAJM Capital has a very low credibility score of 1.25 out of 10.

- Regulation: None

- Transparency: Very Poor

- Customer Feedback: Mostly Negative

WikiFXs investigation shows that NAJM Capital does not hold any license from recognized financial regulators such as the FCA (UK), ASIC (Australia), CySEC (Cyprus), or FSCA (South Africa). This lack of regulation means the broker operates without investor protection or oversight, increasing the risk of fund mismanagement.

WikiFX Rating: 1.25 / 10: Extremely High Risk

Trading Platforms and Conditions

A major concern with NAJM Capital is its lack of clarity regarding trading software. The broker does not specify whether it uses MetaTrader 4 (MT4), MetaTrader 5 (MT5), or any proprietary platform. Furthermore, there are no transparent details about:

- Spreads and commissions

- Leverage ratios

- Execution speed

- Withdrawal processing time

Without this critical information, traders cannot make informed decisions. These omissions often signal unreliable or fraudulent operations.

Regulatory Status and Fund Safety

The cornerstone of a safe broker is regulation. Unfortunately, NAJM Capital fails to provide any verifiable regulatory details or license number. The absence of regulation means:

- No legal protection in case of disputes

- No investor compensation in case of insolvency

- No verified segregation of client funds

Although NAJM Capital claimed that it uses segregated accounts, the lack of transparency makes it difficult to check more details.

Customer Support and Transparency

NAJM Capital‘s website lists limited contact information, with no physical office address or corporate identity disclosed. User feedback across online forums indicates poor communication, slow responses, and unfulfilled withdrawal requests. This lack of accountability reinforces doubts about the broker’s legitimacy.

Victim Reports and User Complaints

Several online users have come forward with disturbing experiences related to NAJM Capital, claiming the broker blocked withdrawals and delayed fund access after profits were made. Below are some reported issues:

- Withdrawal Denial: Traders report that once they attempt to withdraw funds, the broker either stops responding or demands additional “verification fees.”

- Forced Additional Deposits: Some users claim they were told to deposit extra funds to “unlock” their withdrawal or qualify for a “premium verification.”

- Blocked Accounts: After repeated withdrawal attempts, several users allege their accounts were suspended without explanation.

- Lack of Transparency: Victims state that the broker provides no legal documentation or verifiable company registration when requested.

- Fake Customer Support Promises: Traders mention being contacted by so-called “account managers” who pressure them to reinvest profits instead of withdrawing.

These patterns are consistent with known tactics used by unregulated scam brokers, which enticing traders with high returns, delaying withdrawals, and then cutting off communication once significant amounts are deposited.

If you have been affected by NAJM Capital, you are encouraged to file a report on WikiFXs complaint section to assist in future investigations and warn other traders.

Comparison with Similar Unregulated Brokers

| Broker Name | WikiFX Score | Minimum Deposit | Regulatory Status | Verdict |

| NAJM Capital | 1.25 / 10 | $1,000 – $50,000 | Unregulated | High Risk |

| Supremtrade | 1.09 / 10 | $500 – $10,000 | Unregulated | High Risk |

| Duttfx Markets | 1.62 / 10 | $250 – $10,000 | Offshore License (Comoros) | Suspicious |

| WeOwnTrade | 1.05 / 10 | $100 – $5,000 | Unregulated | Unsafe |

| BCRPRO | 1.04 / 10 | $500 – $10,000 | Not Licensed | Potential Scam |

This comparison highlights that NAJM Capital shares many of the same high-risk traits as other unregulated brokers exposed by WikiFX.

Key Red Flags Identified

- ❌ No regulatory license or oversight

- ❌ Extremely high minimum deposits

- ❌ Lack of trading platform transparency

- ❌ Opaque ownership and location details

- ❌ Multiple complaints about withdrawal failures

- ❌ No proof of segregated client funds

All these factors strongly suggest that NAJM Capital may not be a trustworthy platform for real-money trading.

Conclusion: Is NAJM Capital Legit or a Scam?

Based on comprehensive research, NAJM Capital displays multiple red flags that indicate potential scam activity. The absence of regulation, limited transparency, and high deposit thresholds make it unsuitable for any trader who values fund security and operational integrity.

While NAJM Capital promotes itself as a premium trading provider, its WikiFX score, lack of verified credentials, and poor transparency point toward it being an unregulated and potentially unsafe broker.

Trusted Broker Alternatives (Regulated & Reliable)

For traders seeking safe and transparent trading conditions, here are a few trusted, regulated alternatives to consider:

| Broker Name | Regulator | Minimum Deposit | Trading Platforms | WikiFX Score |

| Exness | FCA, CySEC, FSCA | $10 | MT4 / MT5 | 9.31 / 10 |

| HFM (HotForex) | FCA, FSCA, DFSA | $5 | MT4 / MT5 | 9.27 / 10 |

| FP Markets | ASIC, CySEC | $100 | MT4 / MT5 / cTrader | 9.16 / 10 |

| IC Markets | ASIC, CySEC, FSA | $200 | MT4 / MT5 / cTrader | 9.24 / 10 |

| Pepperstone | FCA, ASIC | $0 | MT4 / MT5 / cTrader | 9.38 / 10 |

These brokers are fully regulated, offer transparent trading conditions, segregated client funds, and responsive customer support, making them far safer choices than unregulated entities like NAJM Capital.

Bottom Line

While NAJM Capital attempts to appear as a premium trading service, its unregulated status, lack of transparency, and negative trader feedback tell a different story. Investors are strongly advised to avoid this broker and trade only with licensed, verified platforms backed by strong regulatory oversight.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Fidelity Exposed: Traders Complain About Withdrawal Denials, Frozen Accounts & Platform Glitches

Does Fidelity Investments prevent you from accessing funds despite numerous assurances on your requests? Do you witness an account freeze by the US-based forex broker every time you request withdrawal access? Do you struggle with an unstable trading platform here? Is the slow Fidelity customer service making you face forced liquidation? These issues haunt traders, with many of them voicing their frustration on several broker review platforms such as WikiFX. In this Fidelity review article, we have shared quite a few complaints for you to look at. Read on!

Exposing The Trading Pit: Traders Blame the Broker for Unfair Withdrawal Denials & Account Blocks

Did you receive contradictory emails from The Trading Pit, with one approving payout and another rejecting it, citing trading rule violations? Did you purchase multiple trading accounts but receive a payout on only one of them? Did The Trading Pit prop firm refund you for the remaining accounts without clear reasoning? Did you face account bans despite using limited margins and keeping investment risks to a minimum? These are some raging complaints found under The Trading Pit review. We will share some of these complaints in this article. Take a look.

M&G Review: Traders Report Fund Scams, Misleading Market Info & False Return Promises

Applying for multiple withdrawals at M&G Investments but not getting it into your bank account? Do you see the uncredited withdrawal funds out of your forex trading account on the M&G login? Does the customer support service fail to address this trading issue? Does the misleading market information provided on this forex broker’s trading platform make you lose all your invested capital? Were you lured into investing under the promise of guaranteed forex returns? These issues have become highly common for traders at M&G Investments. In this M&G review article, we have echoed investor sentiments through their complaint screenshots. Take a look!

INZO Broker MT5 Review 2025: A Trader's Guide to Features, Fees and Risks

INZO is a foreign exchange (Forex) and Contracts for Difference (CFD) brokerage company that started working in 2021. The company is registered in Saint Vincent and the Grenadines and regulated offshore. It focuses on serving clients around the world by giving them access to popular trading platforms, especially MetaTrader 5 (MT5) and cTrader. The company offers different types of trading instruments, from currency pairs to cryptocurrencies. It aims to help both new and experienced traders. Read on to know more about it.

WikiFX Broker

Latest News

Forex Expert Recruitment Event – Sharing Insights, Building Rewards

Admirals Cancels UAE License as Part of Global Restructuring

Moomoo Singapore Opens Investor Boutiques to Strengthen Community

OmegaPro Review: Traders Flood Comment Sections with Withdrawal Denials & Scam Complaints

An Unbiased Review of INZO Broker for Indian Traders: What You Must Know

BotBro’s “30% Return” Scheme Raises New Red Flags Amid Ongoing Fraud Allegations

The 5%ers Review: Is it a Scam or Legit? Find Out from These Trader Comments

WikiEXPO Dubai 2025 Concludes Successfully — Shaping a Transparent, Innovative Future

2 Malaysians Arrested in $1 Million Gold Scam Impersonating Singapore Officials

Is FXPesa Regulated? Real User Reviews & Regulation Check

Currency Calculator