简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Greece Still Has The Highest Debt-To-GDP In Europe; Bulgaria The Lowest

Abstract:As European countries pour billions into defense spending, their debt piles are expanding—raising qu

As European countries pour billions into defense spending, their debt piles are expanding—raising questions of national fiscal stability.

In France, a rising debt ratio led Fitch to downgrade its credit rating in September. The country has faced ongoing political turmoil as the countrys debt supply recently hit a record $4 trillion.

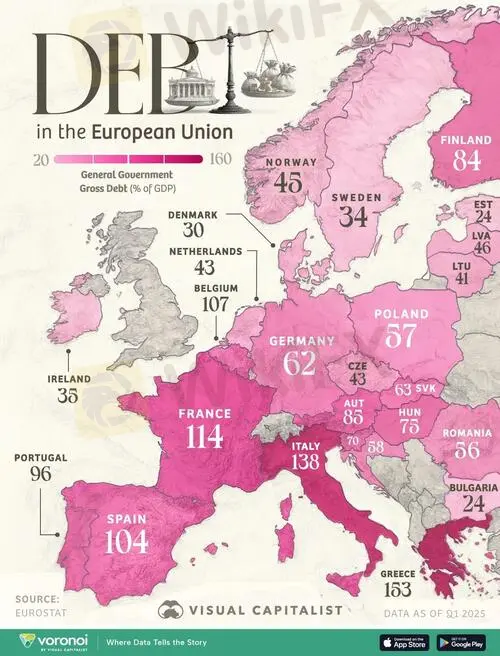

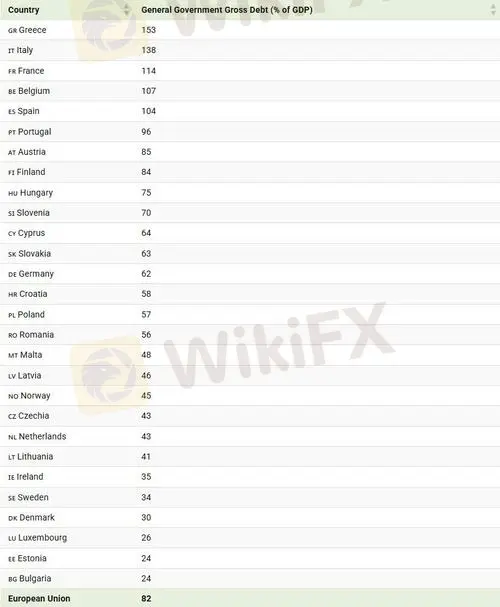

This graphic, via Visual Capitalist's Dorothy Neufeld, shows European Union debt-to-GDP by country, based on data from Eurostat.

The State of European Union Debt-to-GDP in 2025

Below, we show general government gross debt as a percentage of GDP as of Q1 2025 in the EU:

While Greeces economy is thriving in 2025—supported by tourism, real estate, and shipping sectors—its debt situation continues to rank as the worst in the EU.

However, its debt-to-GDP ratio has steadily fallen in recent years, from 180% in 2022 to 153% today. Given its recent economic momentum, the country launched an innovation and infrastructure fund with BlackRock designed to attract $1.2 billion in foreign investment.

Italy holds the second-highest debt-to-GDP ratio in the EU, at 138%. However, the country has made notable progress in narrowing its deficit, cutting it from 7.2% of GDP in 2023 to 3.4% in 2024 on the back of strong tax revenues. Like Greece, its debt levels have been gradually trending downward.

By contrast, debt is rising in France, where it stands at 114% of GDP. In efforts to combat its deteriorating fiscal situation, the French government has raised the retirement age, and proposed cutting two national holidays—stoking public outrage.

Meanwhile, Germanys debt ratio of 62% falls significantly below the EU average of 82%. At the same time, the country has eased its fiscal rules with massive defense spending, causing debt levels to rise.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Simulated Trading Competition Experience Sharing

WinproFx Regulation: A Complete Guide to Its Licensing and Safety for Traders

Interactive Brokers Expands Access to Taipei Exchange

Axi Review: A Data-Driven Analysis for Experienced Traders

INZO Regulation and Risk Assessment: A Data-Driven Analysis for Traders

Cleveland Fed's Hammack supports keeping rates around current 'barely restrictive' level

Delayed September report shows U.S. added 119,000 jobs, more than expected; unemployment rate at 4.4%

The CMIA Capital Partners Scam That Cost a Remisier Almost Half a Million

eToro Cash ISA Launch Shakes UK Savings Market

Is Seaprimecapitals Regulated? A Complete Look at Its Safety and How It Works

Currency Calculator