简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Robo Trading Explained: What It Is and How It Works?

Abstract:Robo trading, also known as automated trading or algorithmic trading, is changing the way people invest in the stock and forex markets. It uses computers and software programs to buy and sell assets automatically based on pre-set rules. If you want to learn about Robo trading and how it works, this simple guide will help you understand everything you need to know.

Robo trading, also known as automated trading or algorithmic trading, is changing the way people invest in the stock and forex markets. It uses computers and software programs to buy and sell assets automatically based on pre-set rules. If you want to learn about robo trading and how it works, this simple guide will help you understand everything you need to know.

What is Robo Trading?

Robo trading is a method where computer programs, called trading robots or bots, handle your trades without needing constant human input. These robots follow specific strategies, analyze market data, and make decisions faster than a human trader. Many traders and investors use robo trading because it can work 24/7, take emotion out of trading, and execute trades more quickly.

How Does Robo Trading Work?

Robo trading works through a few basic steps:

1. Setting the Strategy: Investors or traders choose or create a trading strategy. This could be based on technical analysis, such as moving averages or trend patterns, or fundamental analysis like economic news.

2. Programming or Selecting Bot: Once the strategy is ready, it is programmed into a trading robot. Many trading platforms offer pre-built bots that you can customize, or you can hire developers to create a personalized robot.

3. Connecting to the Market: The robo trading software connects to your trading account through an API (Application Programming Interface). This connection allows the robot to place trades automatically based on your settings.

4. Execution & Monitoring: The robot continuously monitors the market, analyzes data, and executes trades when the conditions match the strategy. You can also set limits like stop-loss or take-profit levels to manage risks.

Benefits of Robo Trading

1. Faster Trade Execution

Robo trading can analyze data and execute trades instantly, helping traders capitalize on market opportunities quickly.

2. Eliminates Emotional Bias

Automated systems follow predefined rules, removing emotional decisions that can lead to mistakes in trading.

3. 24/7 Trading

Robots can operate around the clock, allowing traders to take advantage of global market movements at any time.

4. Consistent Strategy Implementation

Robo trading ensures that trading strategies are followed precisely, leading to more disciplined trading.

5. Saves Time and Effort

Once set up, robo trading handles all trades automatically, freeing traders from constant market monitoring.

Risks of Robo Trading

1. Market Volatility

Robo trading operates based on predefined rules and algorithms. During sudden market changes or unexpected events, the bots may not adapt quickly enough, leading to potential losses. Rapid price swings can catch even the most advanced algorithms off guard.

2. Technical Failures

Since robo trading relies on technology, technical issues such as server outages, connectivity problems, or software bugs can disrupt trading. These failures might cause missed opportunities or unintended trades.

3. Strategy Errors

If the programmed strategy is flawed or not well-tested, it can result in poor trading decisions. An incorrect or outdated strategy can lead to significant losses over time.

4. Over-Reliance on Automation

While automation saves time, traders must monitor their bots regularly. Ignoring updates or not supervising the system can increase risks, especially during unpredictable market conditions.

5. Lack of Human Judgment

Robots lack human intuition and judgment, which are sometimes necessary to interpret complex market signals or news events. Relying solely on robo trading can be risky without human oversight.

Conclusion

Robo trading is a powerful tool that automates the trading process using computers and algorithms. It helps traders execute faster, follow strict rules, and remove emotional biases. However, it's essential to understand the risks and manage your trading robot carefully. By learning how robo trading works, you can decide if it's the right approach for your investment goals.

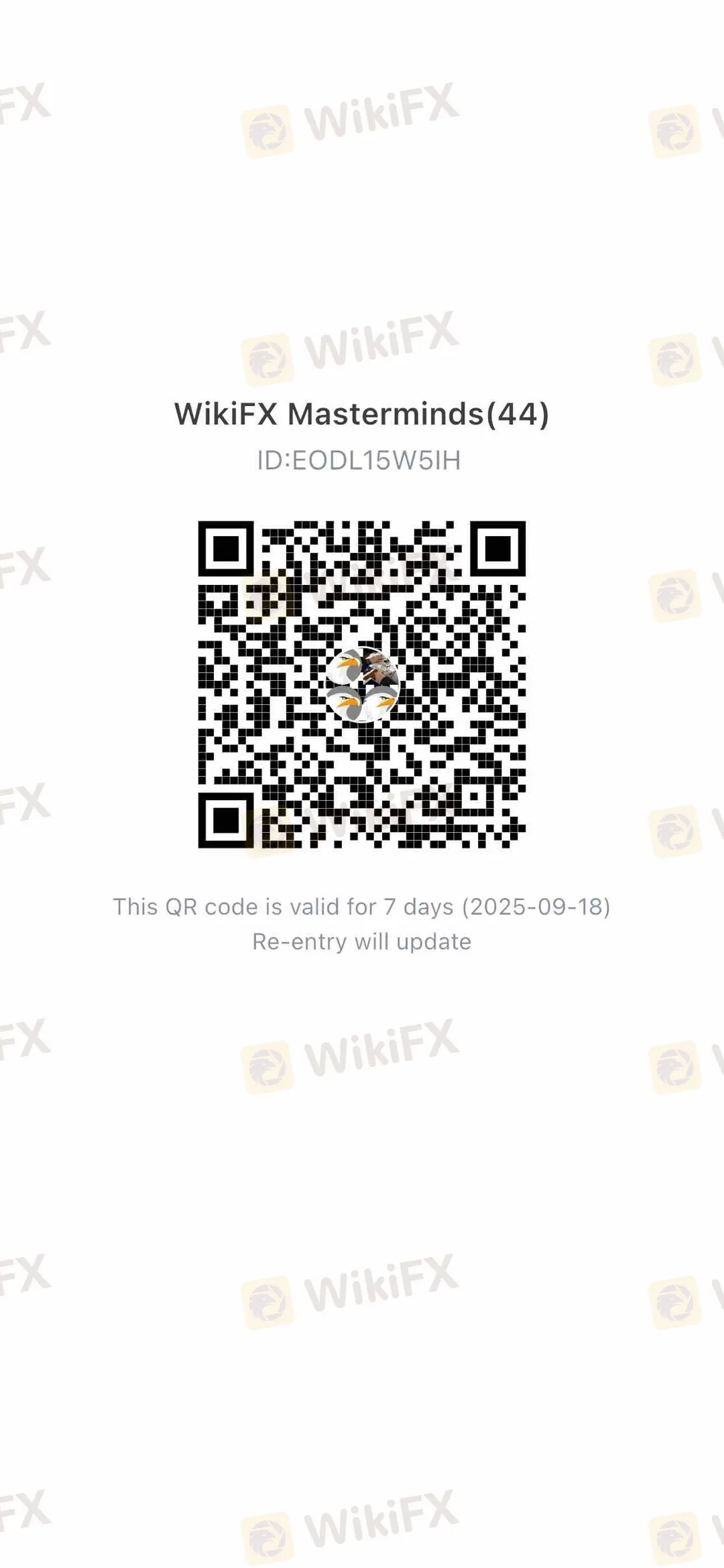

Join WikiFX Community

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Seaprimecapitals Withdrawal Problems: A Complete Guide to Risks and User Experiences

Worries about Seaprimecapitals withdrawal problems and possible Seaprimecapitals withdrawal delay are important for any trader. Being able to get your money quickly and reliably is the foundation of trust between a trader and their broker. When questions come up about this basic process, it's important to look into what's causing them. This guide will tackle these concerns head-on, giving you a clear, fact-based look at Seaprimecapitals' withdrawal processes, user experiences, and trading conditions. Most importantly, we'll connect these real-world issues to the single most important factor behind them: whether the broker is properly regulated. Understanding this connection is key to figuring out the real risk to your capital and making a smart decision.

iFX Brokers Review: Do Traders Face Withdrawal Issues, Deposit Credit Failures & Free Coupon Mess?

Have you had to pay several fees at iFX Brokers? Had your trading profit been transferred to a scamming website, causing you losses? Failed to receive withdrawals from your iFX Brokers trading account? Has your deposit failed to reflect in your trading account? Got deceived in the name of a free coupon? Did the broker officials not help you in resolving your queries? Your problems resonate with many of your fellow traders at iFX Brokers. In this iFX Brokers review article, we have explained these problems and attached traders’ screenshots. Read on!

NinjaTrader Exposed: Why Traders are Calling Out NinjaTrader’s Lifetime Plan & Chart Data

Did NinjaTrader onboard you in the name of the Lifetime Plan, but its ordinary customer service left you in a poor trading state? Do you witness price chart-related discrepancies on the NinjaTrader app? Did you have to go through numerous identity and address proof checks for account approval? These problems occupy much of the NinjaTrader review online. In this article, we have discussed these through complaint screenshots. Take a look!

World Forex Review: Does the Broker Deny Withdrawals and Scam Traders via Fake Bonuses?

Does World Forex prove to be a not-so-happy trading experience for you? Do you struggle to withdraw your funds from the Saint Vincent and the Grenadines-based forex broker? Do you witness hassles depositing funds? Failing to leverage the World Forex no deposit bonus, as it turned out to be false? These accusations are grabbing everyone’s attention when reading the World Forex review online. In this article, we have shared some of these. Read on!

WikiFX Broker

Latest News

Interactive Brokers Expands Access to Taipei Exchange

Simulated Trading Competition Experience Sharing

WinproFx Regulation: A Complete Guide to Its Licensing and Safety for Traders

Axi Review: A Data-Driven Analysis for Experienced Traders

INZO Regulation and Risk Assessment: A Data-Driven Analysis for Traders

Pepperstone CEO: “Taking Down Scam Sites Almost Every Day” Becomes “Depressing Daily Business”

The CMIA Capital Partners Scam That Cost a Remisier Almost Half a Million

Is Seaprimecapitals Regulated? A Complete Look at Its Safety and How It Works

eToro Cash ISA Launch Shakes UK Savings Market

Cleveland Fed's Hammack supports keeping rates around current 'barely restrictive' level

Currency Calculator