简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Propel Capital Shuts Down Amid Fierce UK Rivalry

Abstract:UK prop firm Propel Capital closes after 14 months, citing intense competition as the retail prop trading market faces mounting pressures.

Propel Capital Prop Trading Closure Stuns Traders

London-based proprietary trading firm Propel Capital has announced it is closing operations just 14 months after its launch, marking another setback in the increasingly competitive world of retail prop trading firms.

A Market Exit Driven by Intense Competition

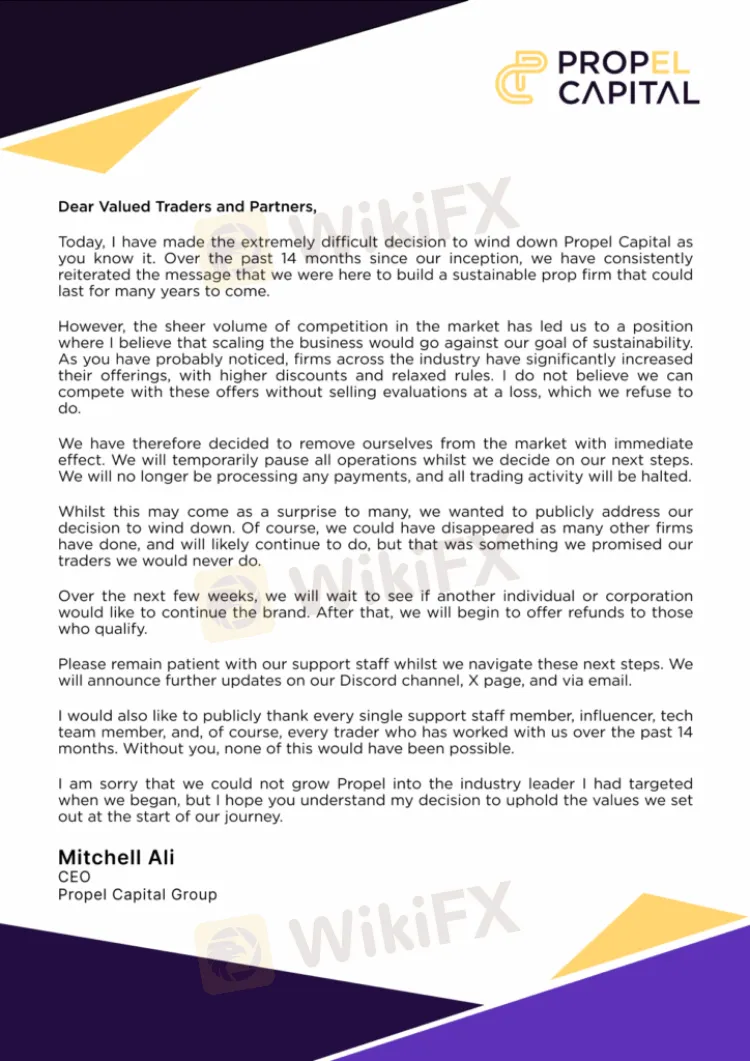

Propel Capital, led by CEO Mitchell Ali—also founder of the online FX platform Apex Partners Group—confirmed the shutdown on August 20, 2025. The firm cited unsustainable competition as the main reason for ceasing operations, with rivals aggressively offering deeper discounts and more relaxed trading conditions.

In a public statement to traders, Ali emphasized the companys refusal to compromise on sustainability or sell evaluation accounts for traders at a loss, a business practice that has strained margins across the industry.

What This Means for Retail Prop Trading

The Propel Capital prop trading closure highlights growing challenges for sustainability in prop firms, as smaller players struggle to scale without sacrificing financial stability. The shutdown also signals a concerning trend, as several UK-based firms have already exited the market this year.

For affected traders, all active accounts have been paused, and the company has committed to processing refunds for eligible participants in the coming weeks. Communication will continue via Propel Capitals social channels and email updates.

Wider Industry Implications

The closure raises key questions for traders and investors alike:

- Why did Propel Capital prop firm, shut down? Intense competition and margin constraints.

- Is prop trading still profitable in the UK? While opportunities remain, increasing rivalry is forcing firms to adapt quickly.

- Best alternatives to Propel Capital prop firm? Larger and more established global entities may absorb some of the displaced traders.

- How does competition impact retail prop trading? Price wars and unsustainable offers are reshaping the landscape.

As the retail prop trading boom in the UK evolves, industry experts warn that only firms with long-term strategies and robust capital structures may survive the tightening conditions.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Vietnam Forex Fraud Kingpin Arrested in Philippines

Vietnam forex fraud suspect Le Khac Ngo arrested in Philippines as authorities uncover record-breaking cross-border investment scam.

Prop Firm Tradeify Signs ‘The Nuke’ as Global Brand Ambassador

Miami-based prop trading firm Tradeify has officially announced a major long-term partnership with Luke “The Nuke” Littler, the current World Number 1 and reigning 2024/2025 PDC Darts World Champion. Littler joins Tradeify as its new Global Brand Ambassador, marking one of the company’s most significant branding investments to date.

Europol Cyber-Patrol Week Targets $55M Crypto Piracy

Europol’s Cyber-Patrol Week exposed $55M in illicit crypto tied to IPTV piracy, disrupting sites and strengthening EU intellectual property enforcement.

Cloudflare Outage Disrupts Broker Websites and Crypto Platforms

Cloudflare outage causes widespread disruption to broker websites and crypto platforms, highlighting risks in web infrastructure reliance.

WikiFX Broker

Latest News

Simulated Trading Competition Experience Sharing

WinproFx Regulation: A Complete Guide to Its Licensing and Safety for Traders

Interactive Brokers Expands Access to Taipei Exchange

Axi Review: A Data-Driven Analysis for Experienced Traders

INZO Regulation and Risk Assessment: A Data-Driven Analysis for Traders

Cleveland Fed's Hammack supports keeping rates around current 'barely restrictive' level

Delayed September report shows U.S. added 119,000 jobs, more than expected; unemployment rate at 4.4%

The CMIA Capital Partners Scam That Cost a Remisier Almost Half a Million

eToro Cash ISA Launch Shakes UK Savings Market

Is Seaprimecapitals Regulated? A Complete Look at Its Safety and How It Works

Currency Calculator