简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Doctor Trapped by 520% Profit Promise, Loses RM8.7 Million

Abstract:A 53-year-old doctor in Malaysia has lost her entire life savings of RM8.7 million after falling prey to a sophisticated online investment scam that promised massive returns from stock trading.

A 53-year-old doctor in Malaysia has lost her entire life savings of RM8.7 million after falling prey to a sophisticated online investment scam that promised massive returns from stock trading.

According to Johor Bahru Selatan deputy police chief Azrul Hisham Shaffei, the woman came across a trading advertisement on social media in April. Intrigued by claims of high profits, she began communicating with an individual featured in the ad to learn more about the investment opportunity.

The scammers presented her with a tempting offer of up to 520% on her capital. Enticed by the promise of fast and substantial profits, she proceeded to transfer large sums of money to multiple bank accounts over three months, from May to July. In total, she deposited RM8.7 million, trusting that her investment would yield high returns.

However, the promised profits never materialised. Instead, the victim was told that her investment had only generated RM6,033. To access her funds, she was instructed to pay an additional RM500,000 as a “deposit”. The scammers threatened to freeze her account if she refused to comply, which ultimately led her to suspect she had been defrauded.

She reported the case to local authorities on Tuesday. The investigation is now underway under Section 420 of the Malaysian Penal Code, which covers offences related to cheating.

This case underscores the tactics commonly used by cybercriminals: exploiting victims trust with offers that appear both legitimate and lucrative. Social media has become a key platform for scammers to reach potential targets, often with well-crafted advertisements and convincing profiles.

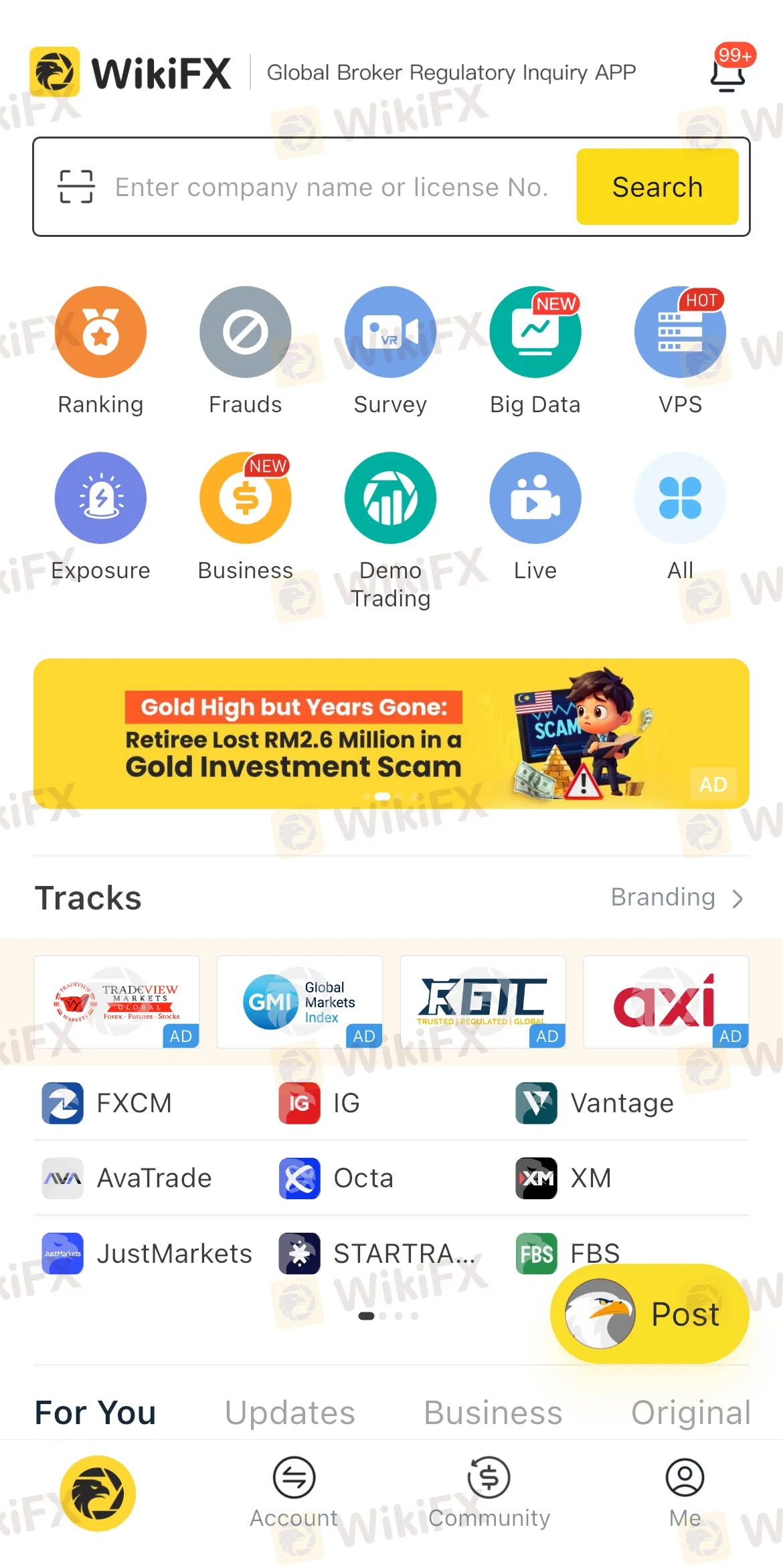

In the wake of such incidents, experts stress the importance of verifying the legitimacy of any investment platform before transferring funds. Tools like WikiFX are proving valuable in this regard. WikiFX offers detailed background checks on brokers, including their regulatory status, customer feedback, and overall safety scores. By providing insights and risk alerts, WikiFX enables users to make informed choices and avoid engaging with unlicensed or fraudulent platforms. With scams growing increasingly sophisticated, conducting proper due diligence can mean the difference between financial security and devastating loss.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Maven Trading Review: Traders Flag Funding Rule Issues, Stop-Loss Glitches & Wide Spreads

Are you facing funding issues with Maven Trading, a UK-based prop trading firm? Do you find Mavin trading rules concerning stop-loss and other aspects strange and loss-making? Does the funding program access come with higher spreads? Does the trading data offered on the Maven Trading login differ from what’s available on the popular TradingView platform? These are some specific issues concerning traders at Maven Trading. Upset by these untoward financial incidents, some traders shared complaints while sharing the Maven Trading Review. We have shared some of their complaints in this article. Take a look.

BTSE Review: Ponzi Scam, KYC Verification Hassles & Account Blocks Hit Traders Hard

Have you lost your capital with BTSE’s Ponzi scam? Did the forex broker onboard you by promising no KYC verification on both deposits and withdrawals, only to be proven wrong in real time? Have you been facing account blocks by the Virgin Islands-based forex broker? These complaints have become usual with traders at BTSE Exchange. In this BTSE review article, we have shared some of these complaints for you to look at. Read on!

Inzo Broker Review 2025: Is It Legit or a High-Risk Gamble?

When you ask, "Is inzo broker legit?" you want a clear, straight answer before putting your money at risk. The truth about Inzo Broker is complicated. Finding out if it's legitimate means looking carefully at its rules, trading setup, and most importantly, the real experiences of traders who have used it. The broker shows a mixed picture - it has official paperwork from an offshore regulator, but it also has many user warnings about how it operates. This review gives you a fair and fact-based investigation. We will break down all the information we can find, from company records to serious user complaints, so you can make your own clear decision.

INZO Broker No Deposit Bonus: A 2025 Deep Dive into Its Offers and Risks

Traders looking for an "inzo broker no deposit bonus" should understand an important difference. While this term is popular, our research shows that the broker's current promotions focus on a $30 welcome bonus and a 30% deposit bonus, rather than a true no-deposit offer. A no-deposit bonus usually gives trading funds without requiring any capital from the client first. In contrast, welcome and deposit bonuses often have rules tied to funding an account or meeting specific trading amounts before profits can be taken out. This article gives a complete, balanced look at INZO's bonus structure, how it operates, and the major risks shown by real trader experiences. Read on!

WikiFX Broker

Latest News

Forex Expert Recruitment Event – Sharing Insights, Building Rewards

Admirals Cancels UAE License as Part of Global Restructuring

Moomoo Singapore Opens Investor Boutiques to Strengthen Community

OmegaPro Review: Traders Flood Comment Sections with Withdrawal Denials & Scam Complaints

An Unbiased Review of INZO Broker for Indian Traders: What You Must Know

BotBro’s “30% Return” Scheme Raises New Red Flags Amid Ongoing Fraud Allegations

The 5%ers Review: Is it a Scam or Legit? Find Out from These Trader Comments

WikiEXPO Dubai 2025 Concludes Successfully — Shaping a Transparent, Innovative Future

2 Malaysians Arrested in $1 Million Gold Scam Impersonating Singapore Officials

Is FXPesa Regulated? Real User Reviews & Regulation Check

Currency Calculator