简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

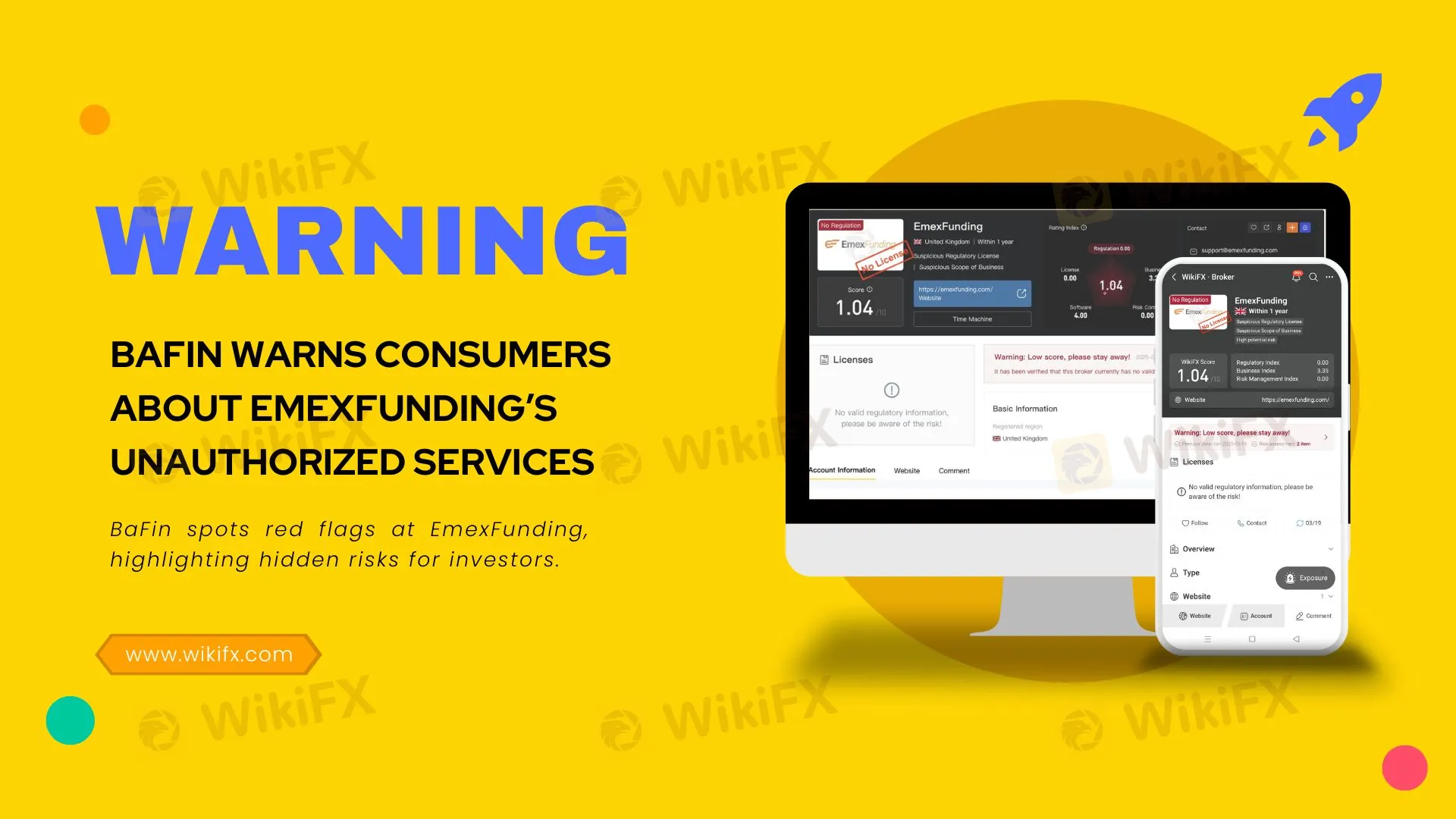

BaFin Warns Consumers About EmexFunding’s Unauthorized Services

Abstract:BaFin spots red flags at EmexFunding, highlighting hidden risks for investors.

The German Federal Financial Supervisory Authority (BaFin) has issued a critical consumer alert about the activities of EmexFunding, an unauthorized financial services provider operating through the website emexfunding.com.

BaFin's investigation revealed that EmexFunding, whose operators remain unidentified, is offering financial, investment, and cryptocurrency services without the necessary regulatory permissions. The company falsely operates under the business name “EmexFunding GmbH,” claiming its registered office is in Corby, United Kingdom. However, official records verify that such a company does not exist, indicating a clear attempt to mislead potential customers.

A significant concern raised by BaFin involves EmexFunding's promotion of a so-called “Handelskreditvertrag” (trading credit agreement). Through this misleading document, the firm encourages consumers to secure loans specifically for trading financial products and cryptoassets on its platform. Such tactics pose considerable risks, potentially leading consumers into substantial financial losses and debt.

Under German legislation—including the German Banking Act (Kreditwesengesetz - KWG) and the German Cryptomarkets Supervision Act (Kryptomärkteaufsichtsgesetz)—entities must obtain explicit authorization from BaFin to offer financial or investment-related services. EmexFunding lacks such authorization, rendering its operations unlawful and exposing investors to significant risks.

Additionally, a search conducted through the regulatory verification platform WikiFX corroborates BaFin's concerns. WikiFX reports EmexFunding as having no valid regulatory licenses and assigns it a notably low reliability rating, further emphasizing the dangers of engaging with this unauthorized provider.

BaFin strongly advises investors to perform thorough due diligence by consulting official regulatory databases and trusted platforms such as WikiFX before committing funds to any financial service providers. Engaging with unauthorized companies such as EmexFunding can result in limited legal protections and the inability to recover invested funds.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Fidelity Exposed: Traders Complain About Withdrawal Denials, Frozen Accounts & Platform Glitches

Does Fidelity Investments prevent you from accessing funds despite numerous assurances on your requests? Do you witness an account freeze by the US-based forex broker every time you request withdrawal access? Do you struggle with an unstable trading platform here? Is the slow Fidelity customer service making you face forced liquidation? These issues haunt traders, with many of them voicing their frustration on several broker review platforms such as WikiFX. In this Fidelity review article, we have shared quite a few complaints for you to look at. Read on!

Exposing The Trading Pit: Traders Blame the Broker for Unfair Withdrawal Denials & Account Blocks

Did you receive contradictory emails from The Trading Pit, with one approving payout and another rejecting it, citing trading rule violations? Did you purchase multiple trading accounts but receive a payout on only one of them? Did The Trading Pit prop firm refund you for the remaining accounts without clear reasoning? Did you face account bans despite using limited margins and keeping investment risks to a minimum? These are some raging complaints found under The Trading Pit review. We will share some of these complaints in this article. Take a look.

M&G Review: Traders Report Fund Scams, Misleading Market Info & False Return Promises

Applying for multiple withdrawals at M&G Investments but not getting it into your bank account? Do you see the uncredited withdrawal funds out of your forex trading account on the M&G login? Does the customer support service fail to address this trading issue? Does the misleading market information provided on this forex broker’s trading platform make you lose all your invested capital? Were you lured into investing under the promise of guaranteed forex returns? These issues have become highly common for traders at M&G Investments. In this M&G review article, we have echoed investor sentiments through their complaint screenshots. Take a look!

Trading Pro Review: Scam Broker Exposed

Trading Pro Review reveals scam alerts, fake offices, and withdrawal issues. Stay cautious with this unregulated broker.

WikiFX Broker

Latest News

Forex Expert Recruitment Event – Sharing Insights, Building Rewards

Admirals Cancels UAE License as Part of Global Restructuring

Moomoo Singapore Opens Investor Boutiques to Strengthen Community

OmegaPro Review: Traders Flood Comment Sections with Withdrawal Denials & Scam Complaints

An Unbiased Review of INZO Broker for Indian Traders: What You Must Know

BotBro’s “30% Return” Scheme Raises New Red Flags Amid Ongoing Fraud Allegations

The 5%ers Review: Is it a Scam or Legit? Find Out from These Trader Comments

WikiEXPO Dubai 2025 Concludes Successfully — Shaping a Transparent, Innovative Future

2 Malaysians Arrested in $1 Million Gold Scam Impersonating Singapore Officials

Is FXPesa Regulated? Real User Reviews & Regulation Check

Currency Calculator