简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

MultiBank Group: Something You Need to Know About This Broker

Abstract:Multibank Group, or MEX Global Financial Service LLC, is a global forex broker founded in 2005 that offers various market instruments. In today’s article, we will show you whether MultiBank Group is a scam or a reliable broker.

Please continue to read if you want to know whether MultiBank Group is a reliable forex broker.

In this article

WikiFX provides inquiry services in the forex field.

WikiFX evaluates the reliability of MultiBank Group based on the facts.

What is WikiFX?

| WikiFX is an authoritative global inquiry platform that provides basic information and regulatory license inquiries. |

| WikiFX can evaluate the safety and reliability of more than 59,000 global forex brokers. |

| WikiFX gives you a huge advantage while seeking the best forex brokers. For more information, such as the review and exposure of brokers, please visit our website (https://www.WikiFX.com/en) |

To explore whether MultiBank Group is a scammer, we evaluated this broker based on various aspects, such as regulatory status.

1. Evaluate the reliability of MultiBank Group based on its general information and regulatory status

To understand MultiBank Group better, we explore it by analyzing two main perspectives:

A. General Info of MultiBank Group

B. Regulatory Status

A. General Info of MultiBank Group

MultiBank Groups general info is shown below:

About MultiBank Group

MultiBank Group, which operates under the name MEX Global Financial Services LLC, is registered in the United Arab Emirates and offers a variety of market instruments to its traders, including forex, commodities, indices, metals, and cryptocurrencies. Traders can access more than 1,000 trading instruments across different markets, allowing them to diversify their portfolios and take advantage of different market conditions. MultiBank Group claims to have a strong presence in the Asia-Pacific region, with offices in China, the Philippines, and Malaysia, among others. The broker also emphasizes its commitment to providing clients with competitive pricing, advanced trading tools, and a high level of customer support.

Account Type & Minimum Deposit

This broker offers three different types of accounts. The Standard account, the Professional account, and the ECN account. The Standard account is designed for novice traders who want to start trading with an average deposit amount of $200. The Professional account is designed for more experienced traders who want access to more advanced trading tools and features, with a minimum deposit of $1,000. The minimum deposit requirement is higher than the other two accounts, starting from $5,000.

Leverage

MultiBank Group offers leverage up to 500:1 for forex trading.

Trading Platform

MultiBank Group offers its clients two of the most popular trading platforms in the industry, MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Spreads and Commissions (Trading Fees)

One important aspect of trading that all traders must consider is the cost involved in executing trades, and obviously, MultiBank Group understands this.

The spreads on offer depend on the type of trading account. The spreads for its Standard account start from as low as 1.5 pips for major currency pairs, while the ECN account offers the tightest spreads. As for commissions, they are charged on a per-lot basis, with the amount varying depending on the instrument being traded and the type of account being used. However, the Standard account does not have commission-based pricing.

Deposits and Withdrawals

MultiBank Group offers limited options for both deposits and withdrawals, including bank wire transfers, credit/debit cards, and online payment methods such as Skrill, and Neteller.

Customer Support

MultiBank Group provides customer support to its clients through various channels, including phone, email, live chat, and social media. The customer support team is available 24/5 and can assist with any account-related queries, technical issues, or general inquiries.

B. Regulatory Status

What is a Legitimate License?

- The legitimate license is the business license issued by the financial regulatory institution of each country/region.

- Holding a license means that the broker is recognized and regulated by the regulatory authority, therefore your money is under protection to some extent.

- Whether a forex brokerage firm holds a legitimate license or not is one of the important factors in evaluating the reliability of forex brokers.

- The regulation's content and the difficulty of obtaining a license vary by country and agency issuing the license.

The legitimate license of MultiBank Group

As we know so far, MultiBank Group is regulated.

2. The feedback from social media platforms

To figure out whether this broker is a scam or not, we did a survey about this broker on social media platforms.

- MultiBank Group has official accounts on X, Instagram, and Facebook

- MultiBank Group Philippine account on X has stopped to updated since August 2025

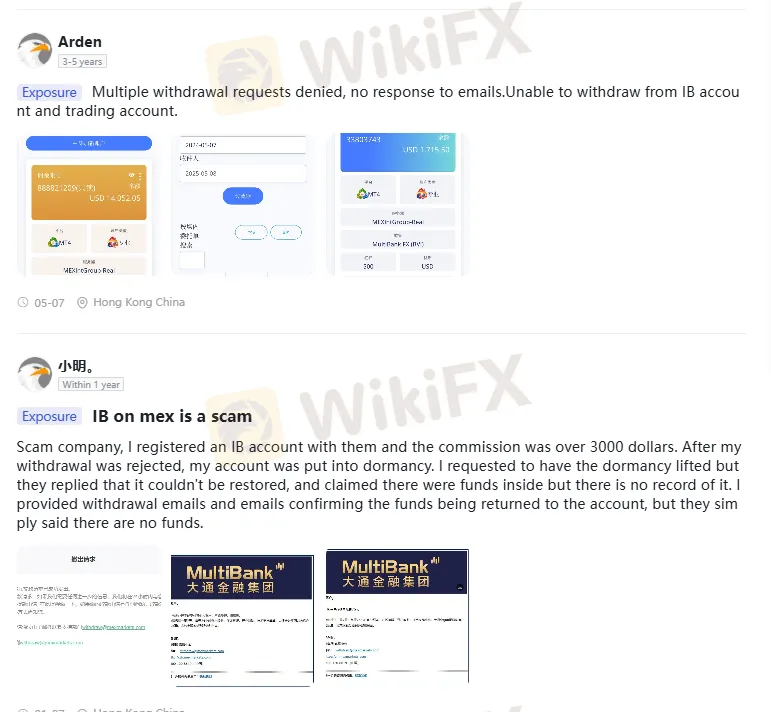

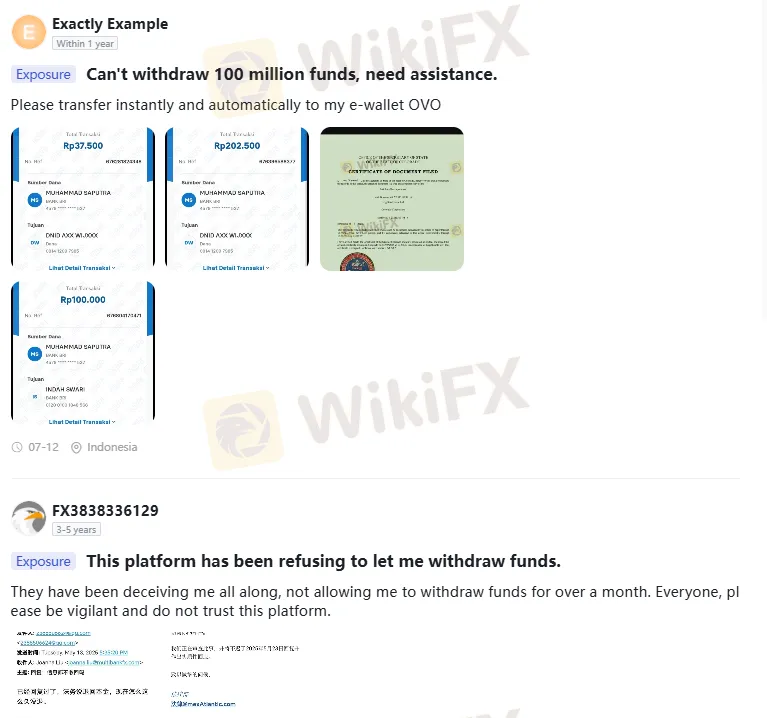

3. Too Many Complaints

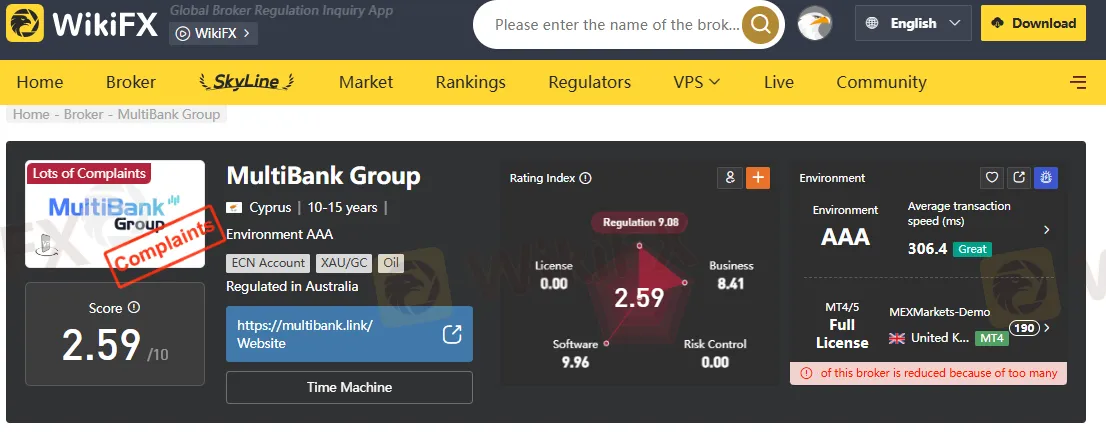

Recently, WikiFX has receive more than 700 complaints against MultiBank Group. Many traders claimed that MultiBank Group is a scam and it blocks the withdrawal request.

4. Special survey about MultiBank Group from WikiFX

Scoring Criteria

WikiFX gives brokers a score from 0 to 10. The higher the score is, the more reliable the broker is.

| The Scoring Criteria of Brokers on WikiFX |

| License index: reliability and value of licenses |

| Regulatory index: license regulatory strength |

| Business index: enterprise stability and operational capability |

| Software index: trading platform, instruments, etc |

| Risk Management index: the degree of asset security |

MultiBank Group has been given by WikiFX a low rating of 2.58/10.

5. Conclusion

All over, MultiBank Group is not a sophisticated broker that offers excellent trading services to its global clients. It is regulated, however, there are too many complaints against it. WikiFX has given this broker a low score, which shows a red flag for investing in this broker. We still want to remind you of the potential risk. If you want to know more information about the reliability of certain brokers, you can open our website (https://www.WikiFX.com/en). Or you can download the WikiFX APP to find the most trusted broker for yourself.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Voices of the Golden Insight Award Jury | Kazuaki Takabatake, CCO of Titan FX

WikiFX Golden Insight Award uniting industry forces to build a safe and healthy forex ecosystem, driving industry innovation and sustainable development, launches a new feature series — “Voices of the Golden Insight Awards Jury.” Through in-depth conversations with distinguished judges, this series explores the evolving landscape of the forex industry and the shared mission to promote innovation, ethics, and sustainability.

Garanti BBVA Securities Exposed: Traders Report Unfair Charges & Poor Customer Service

Have you been financially ruined through chargebacks allowed by Garanti BBVA Securities? Do you have to wait for hours to get your queries resolved by the broker’s customer support official? Did the same scenario prevail when you contact the officials in-person? Failed to close your account as Garanti BBVA Securities officials remained unresponsive to your calls? Many have expressed similar concerns while sharing the Garanti BBVA Securities review online. In this article, we have shared some complaints against the broker. Take a look!

In-Depth Review of Stonefort Securities Withdrawals and Funding Methods – What Traders Should Really

For any experienced forex and CFD trader, the mechanics of moving capital are as critical as the trading strategy itself. The efficiency, security, and transparency of a broker's funding procedures form the bedrock of a trustworthy, long-term trading relationship. A broker can offer the tightest spreads and the most advanced platform, but if depositing funds is cumbersome or withdrawing profits is a battle, all other advantages become moot. This review provides a data-driven examination of Stonefort Securities withdrawals and funding methods. We will dissect the available information on payment options, processing times, associated costs, and the real-world user experience. Our analysis is anchored primarily in data from the global broker regulatory inquiry platform, WikiFX, supplemented by a critical look at publicly available information to provide a comprehensive and unbiased perspective for traders evaluating this broker.

MH Markets Deposits and Withdrawals Overview: A Data-Driven Analysis for Traders

For any experienced trader, the integrity of a broker is not just measured by its spreads or platform stability, but by the efficiency and reliability of its financial plumbing. The ability to deposit and, more importantly, withdraw capital without friction is a cornerstone of trust. This review provides an in-depth, data-driven analysis of the MH Markets deposits and withdrawals overview, examining the entire fund management lifecycle—from funding methods and processing speeds to fees and potential obstacles. MH Markets, operating for 5-10 years under the name Mohicans Markets (Ltd), has established a global footprint. With a WikiFX score of 7.08/10, it positions itself as a multi-asset broker offering a range of account types and access to the popular MetaTrader platforms. However, for a discerning trader, the real test lies in the details of its payment systems and the security of their funds. This article dissects the MH Markets funding methods withdrawal experience, leveraging pr

WikiFX Broker

Latest News

The 350 Per Cent Promise That Cost Her RM604,000

In-Depth Uniglobe Markets Commission Fees and Spreads Analysis – What Traders Should Really Know

WikiFX's New Evaluation of ATM Capital LTD: Does its License Protect the Arab Investor?

Is Axi Legit? A Data-Driven Analysis of Its Regulatory Standing and Trader Feedback

How a Fake Moomoo Ad Led to the “New Dream Voyage 5” Scam

FXPesa Review: Are Traders Facing High Slippage, Fund Losses & Withdrawal Denials?

Trive Investigation: High Score, Hidden Risk - The Profit Paradox

CMC Markets Australia Revenue Surges 34%, But High-Net-Worth Clients Face Tax Phishing Threat

"Just 9 More Lots": Inside the Endless Withdrawal Loop at Grand Capital

GCash Rolls Out Virtual US Account to Cut Forex Fees for Filipinos

Currency Calculator