简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Mohamad Ibrahim, CEO of XS.com, Stops Salary Payments to Asian Staff

Abstract:An investigation for the allegations against XS.com's CEO, Mohamad Ibrahim, for halting salary payments to Asian and African employees. It details Ibrahim's professional background, employee grievances, and the company's controversial responses, exploring the impact on XS.com's reputation and the wider fintech industry. The report emphasizes the importance of ethical leadership and corporate accountability.

The corporate ethics and financial stability of XS.com, a prominent global fintech player, have been brought into question following recent allegations against its CEO, Mohamad Ibrahim. Accused of halting salaries for the company's Asian and African employees, Ibrahim's actions have stirred a mix of concern and outrage both within and beyond the organization. This report delves into the unfolding controversy, examining the claims, the responses, and the broader implications for XS.com and the industry at large.

Mohamad Ibrahim's Professional Background

Highlighting Mohamad Ibrahim's ascent to CEO after his tenure as Regional Director at Exness, this section establishes his professional pedigree. Concurrently, it outlines XS.com's market position, emphasizing its regulatory compliance across various jurisdictions. The contrast between the company's standing and the recent allegations paints a complex picture of leadership and corporate governance.

Detailed Employee Allegations

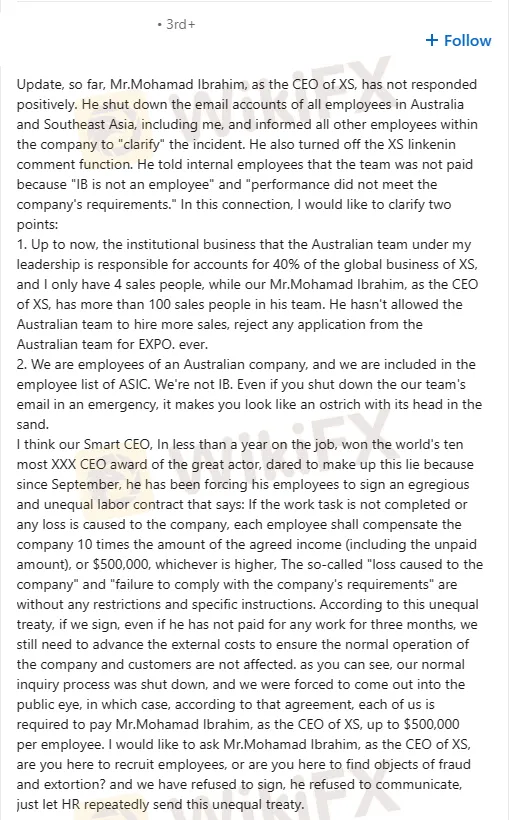

This section offers a comprehensive view of the employees' grievances. It elaborates on the cessation of salaries and commissions, underscoring the severity and personal impact on staff. The narrative is enriched with direct quotes from affected employees, particularly focusing on the Australian team's leader, who highlights their critical role in the company's global operations. The detailed account underscores the discord between the employees' contributions and the CEO's alleged disregard for their welfare.

Investigating Ibrahim's actions post-allegations, this part scrutinizes the shutting down of email accounts, the silencing of online discourse, and the controversial labor contracts introduced. The analysis probes into the legal and ethical dimensions of these actions, questioning their alignment with the company's stated values and regulatory commitments.

This segment assesses the ripple effects of the controversy on XS.com's market standing and corporate image. It debates potential repercussions for investor confidence, client relations, and internal morale. The discussion extends to the fintech industry at large, contemplating the incident's influence on sector-wide ethical standards and regulatory scrutiny.

Bottom line

In conclusion, the release reemphasizes the gravity of the allegations against Mohamad Ibrahim and the imperative for transparent, ethical leadership in the finance sector. It calls for a balanced but thorough investigation into the matter, underscoring the need for accountability and corporate responsibility.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Fidelity Exposed: Traders Complain About Withdrawal Denials, Frozen Accounts & Platform Glitches

Does Fidelity Investments prevent you from accessing funds despite numerous assurances on your requests? Do you witness an account freeze by the US-based forex broker every time you request withdrawal access? Do you struggle with an unstable trading platform here? Is the slow Fidelity customer service making you face forced liquidation? These issues haunt traders, with many of them voicing their frustration on several broker review platforms such as WikiFX. In this Fidelity review article, we have shared quite a few complaints for you to look at. Read on!

Exposing The Trading Pit: Traders Blame the Broker for Unfair Withdrawal Denials & Account Blocks

Did you receive contradictory emails from The Trading Pit, with one approving payout and another rejecting it, citing trading rule violations? Did you purchase multiple trading accounts but receive a payout on only one of them? Did The Trading Pit prop firm refund you for the remaining accounts without clear reasoning? Did you face account bans despite using limited margins and keeping investment risks to a minimum? These are some raging complaints found under The Trading Pit review. We will share some of these complaints in this article. Take a look.

M&G Review: Traders Report Fund Scams, Misleading Market Info & False Return Promises

Applying for multiple withdrawals at M&G Investments but not getting it into your bank account? Do you see the uncredited withdrawal funds out of your forex trading account on the M&G login? Does the customer support service fail to address this trading issue? Does the misleading market information provided on this forex broker’s trading platform make you lose all your invested capital? Were you lured into investing under the promise of guaranteed forex returns? These issues have become highly common for traders at M&G Investments. In this M&G review article, we have echoed investor sentiments through their complaint screenshots. Take a look!

Trading Pro Review: Scam Broker Exposed

Trading Pro Review reveals scam alerts, fake offices, and withdrawal issues. Stay cautious with this unregulated broker.

WikiFX Broker

Latest News

2 Malaysians Arrested in $1 Million Gold Scam Impersonating Singapore Officials

Moomoo Singapore Opens Investor Boutiques to Strengthen Community

OmegaPro Review: Traders Flood Comment Sections with Withdrawal Denials & Scam Complaints

An Unbiased Review of INZO Broker for Indian Traders: What You Must Know

BotBro’s “30% Return” Scheme Raises New Red Flags Amid Ongoing Fraud Allegations

The 5%ers Review: Is it a Scam or Legit? Find Out from These Trader Comments

WikiEXPO Dubai 2025 Concludes Successfully — Shaping a Transparent, Innovative Future

Admirals Cancels UAE License as Part of Global Restructuring

Forex Expert Recruitment Event – Sharing Insights, Building Rewards

Exness Broker Expands in South Africa with Cape Town Hub

Currency Calculator