简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Broker Assessment Series | Is Sway Markets Reliable?

Abstract:This article is about to shed light on the broker named Sway Markets.

About Sway Markets

Sway Markets is an online broker offering trading services in forex, commodities, and cryptocurrencies. The company was established in 2022 and is headquartered in Australia. Sway Markets offers a diverse range of trading instruments, including forex, crypto, stocks, indices, commodities, and futures. This can be beneficial for traders who are looking to diversify their portfolios and take advantage of different market opportunities.

Is it Legit?

Sway Markets is a regulated broker which is regulated by ASIC with a license number 001300469.

Accounts Types&Minimum Deposit

Sway Markets offers four different account types, including ECN, No Commission, VIP, and Islamic accounts.

ECN Account: This account type offers spreads starting from 0.8 pips and commission from $7.5 per lot.

No Commission Account: This account type offers spreads starting from 1.2 pips and no commission fees.

VIP Account: This account type offers spreads starting from 0.3 pips and commission from $3.5 per lot.

Islamic Account: This account type is designed for traders who want to trade in accordance with Shariah law. Islamic accounts have no swap or rollover fees, but they have wider spreads compared to the other account types.

The minimum deposit is $10. Each account type has its own advantages and disadvantages, and traders can choose the one that best suits their trading needs and preferences.

Leverage

It is important to note that leverage is a risky tool that can amplify both profits and losses. While Sway Markets may offer leverage up to 1:500.

Spreads & Commissions

Sway Markets offers different account types with varying spreads and commissions. The ECN and Islamic accounts seem to have the lowest spreads starting from 0.8 pips, while the No Commission accounts have slightly higher spreads starting from 1.2 pips. The VIP accounts seem to have the lowest spreads starting from 0.3 pips and a commission per lot of $3.50.

On the other hand, the ECN and Islamic accounts seem to have the highest commission per lot starting from $7.50, while the No Commission accounts have no commission charges. It's important to note that these values may depend on the trading instrument and the trading volume.

Overall, Sway Markets seems to offer competitive trading conditions with various account types to cater to different trading needs.

Trading Platforms

Sway Markets offers the popular MetaTrader5 (MT5) platform. The MT5 platform is available for download on desktop and mobile devices, allowing traders to access their accounts and trade from anywhere with an internet connection. The platform features a wide range of trading tools and indicators, as well as the ability to use automated trading strategies through Expert Advisors (EAs).

Sway Markets on Social Media Platforms

Sway Markets has made a recent announcement on its official X account, mainly that the broker has now enabled USDT & ETH as part of its Funding Methods.

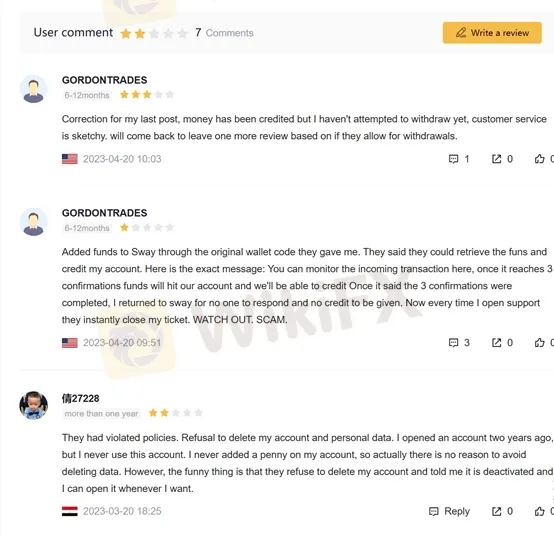

Feedback on Sway Markets

On WikiFX, there is a comment section on the main page of certain brokers. registered investors can add their thoughts about the broker. WikiFX hasnt received exposures related to this broker yet. But we advise you to choose a broker with care.

Conclusion

If you want to know more information about the reliability of certain brokers, you can open our website (https://www.WikiFX.com/en). Or you can download the WikiFX APP to find the most trusted broker for yourself.

The WikiFX score of a broker can be increased or decreased if the broker is constantly running the business in a good or bad direction. Before deciding to invest in this broker, make sure to open WikiFX and check the latest updates about this broker, so you may not regret every step you make.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

IG Japan to Halt Crypto ETF CFDs as FSA Tightens Rules

IG Japan will end cryptocurrency ETF CFDs after new FSA guidance, forcing traders to close positions by January 31, 2026, under stricter crypto rules.

FONDEX Review: Do Traders Really Face Inflated Spreads & Withdrawal Issues?

Does FONDEX charge you spreads more than advertised to cause you trading losses? Does this situation exist even when opening a forex position? Do you witness customer support issues regarding deposits and withdrawals at FONDEX broker? Does the customer support official fail to explain to you the reason behind your fund loss? In this article, we have shared FONDEX trading complaints. Read on!

IEXS Regulation: A Complete Guide to Its Licenses and Safety Warnings

When choosing a broker, every trader's biggest concern is safety and trust: is it regulated? For IEXS, the answer isn't simply YES or NO. While the company says it's regulated by trusted authorities, looking closer shows a complicated and worrying situation with mixed evidence and serious risks. What they claim on the surface doesn't match up with official warnings, license problems, and many bad user experiences. This article gives you a detailed, fact-based look into IEXS regulations, breaking down their official licenses, what their trading platform is really like, and real stories from traders who have used it. Our goal is to give you the facts so you can make a smart decision about keeping your money safe.

IEXS Review 2025: A Complete Expert Analysis

Choosing the right forex broker requires careful research. IEXS, a broker that has been operating for 5-10 years, shows a mixed picture for traders. The company is based in the UK and claims to serve customers worldwide, offering many different trading options on the popular MT4 platform. However, when we look closely at its licenses and read what users say about it, we find serious problems that potential customers need to know about. This review gives you a complete analysis based on publicly available information, focusing on regulation, trading conditions, how well the platform works, and real experiences from users.

WikiFX Broker

Latest News

The Debt-Reduction Playbook: Can Today's Governments Learn From The Past?

Trillium Financial Broker Exposed: Top Reasons Why Traders are Losing Trust Here

FIBO Group Ltd Review 2025: Find out whether FIBO Group Is Legit or Scam?

Amillex Withdrawal Problems

Is INGOT Brokers Safe or Scam? Critical 2025 Safety Review & Red Flags

150 Years Of Data Destroy Democrat Dogma On Tariffs: Fed Study Finds They Lower, Not Raise, Inflation

【WikiEXPO Global Expert Interviews】Ashish Kumar Singh: Building a Responsible and Interoperable Web3

Trump: India\s US exports jump despite 50% tariffs as trade tensions ease

CQG Partners with Webull Singapore to Power the Broker’s New Futures Trading Offering

IEXS Review 2025: A Complete Expert Analysis

Currency Calculator