简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FXPRIMUS: Withdrawal Issues Met with 0 Support

Abstract:A recent experience by one trader has unveiled a troubling side of the industry, exposing the issues at FXPRIMUS and the vital role that WikiFX plays in resolving disputes.

In the fast-paced world of online trading, traders entrust their hard-earned money to brokers with the expectation of swift and seamless transactions. However, a recent experience by one trader has unveiled a troubling side of the industry, underscoring the significance of responsive customer service and the vital role that WikiFX plays in resolving disputes.

Investor embarked on their journey with FXPRIMUS, depositing $2000 and diligently following the broker's guidance, which resulted in a healthy profit of $3000. Eager to reap the rewards of their efforts, Investor initiated a $5000 withdrawal request.

What should have been a simple process spiraled into a nightmare as Investor found themselves unable to complete the withdrawal. Anxious and frustrated, they turned to FXPRIMUS's customer service for help. Here's where the problem escalated; Investor's calls for assistance went unanswered. Their messages and pleas seemed to fall into a void, intensifying their already precarious situation.

This unresponsiveness from FXPRIMUS's customer service further complicated Investor's predicament, exposing a critical issue in the industry. Reliable and responsive customer support is vital for traders to address concerns and resolve issues efficiently. In its absence, traders like Investor are left in a state of vulnerability and distress.

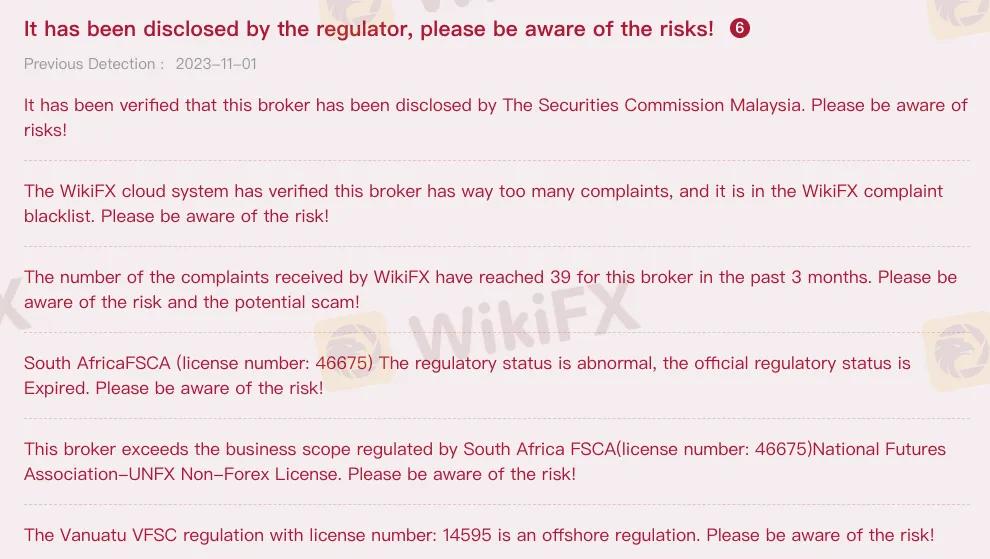

WikiFX is a renowned global forex regulatory query platform that houses verified information of over 50,000 brokers. Based on the database of WikiFX, FXPRIMUS has a low WikiScore, which further indicates that it is a broker with low credibility. For this trader, had he taken a moment to review WikiFX before getting involved with FXPRIMUS, he might have avoided the current distress he is going through.

In addition to aiding individuals in their immediate concerns, WikiFX's Exposure service is on a larger mission. It is dedicated to bolstering transparency and accountability in the financial industry. WikiFX acts as a watchdog in the industry, scrutinizing brokers to uncover any unethical or fraudulent practices. When traders report issues, it helps shed light on brokers engaging in dubious activities. By exposing unscrupulous brokers, WikiFX raises awareness about potential pitfalls and risks in the market. This information is invaluable for traders, helping them make informed decisions and avoid falling victim to untrustworthy brokers.

In essence, WikiFX's Exposure service serves as a vital bridge between traders facing unresolved disputes and potential solutions. It not only provides a platform for sharing grievances but also contributes to the broader mission of ensuring transparency, accountability, and safety in the financial industry.

Stop waiting and get your free WikiFX mobile application from Google Play or App Store now!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

CMC Markets Australia Revenue Surges 34%, But High-Net-Worth Clients Face Tax Phishing Threat

CMC Markets Australia reports a 34% revenue surge. Simultaneously, the company's high-net-worth clients are facing a serious tax-related phishing threat.

E TRADE Review: Traders Report Tax on Withdrawals, Poor Customer Service & Fund Scams

Has your E Trade forex trading account been charged a withholding tax fee? Did your account get blocked because of multiple deposits? Did you have to constantly call the officials to unblock your account? Failed to open a premium savings account despite submitting multiple documents? Is fund transfer too much of a hassle at E Trade? Did you find the E Trade customer support service not helpful? In this E Trade review article, we have shared certain complaints. Take a look!

mBank Exposed: Top Reasons Why Customers are Giving Thumbs Down to This Bank

Do you find mBank services too slow or unresponsive? Do you find your account getting blocked? Failing to access your account online due to several systemic glitches? Can’t perform the transactions on the mBank app? Do you also witness inappropriate stop-level trade execution by the financial services provider? You are not alone! Frustrated by these unfortunate circumstances, many of its clients have shared negative mBank reviews online. In this article, we have shared some of the reviews. Read on!

In-Depth Uniglobe Markets Commission Fees and Spreads Analysis – What Traders Should Really Know

For experienced traders, the cost of execution is a critical factor in broker selection. Low spreads, fair commissions, and transparent pricing can be the difference between a profitable and a losing strategy over the long term. This has led many to scrutinize the offerings of brokers like Uniglobe Markets, which presents a tiered account structure promising competitive conditions. However, a professional evaluation demands more than a surface-level look at marketing claims. It requires a deep, data-driven analysis of the real trading costs, set against the backdrop of the broker's operational integrity and safety. This comprehensive Uniglobe Markets commission fees and spreads analysis will deconstruct the broker's pricing model, examining its account types, typical spreads, commission policies, and potential ancillary costs. Using data primarily sourced from the global broker inquiry platform WikiFX, we will provide a clear-eyed view of the Uniglobe Markets spreads commissions prici

WikiFX Broker

Latest News

In-Depth Uniglobe Markets Commission Fees and Spreads Analysis – What Traders Should Really Know

WikiFX's New Evaluation of ATM Capital LTD: Does its License Protect the Arab Investor?

Is Axi Legit? A Data-Driven Analysis of Its Regulatory Standing and Trader Feedback

How a Fake Moomoo Ad Led to the “New Dream Voyage 5” Scam

FXPesa Review: Are Traders Facing High Slippage, Fund Losses & Withdrawal Denials?

Trive Investigation: High Score, Hidden Risk - The Profit Paradox

CMC Markets Australia Revenue Surges 34%, But High-Net-Worth Clients Face Tax Phishing Threat

Bessent believes there won't be a recession in 2026 but says some sectors are challenged

mBank Exposed: Top Reasons Why Customers are Giving Thumbs Down to This Bank

Young Singaporean Trader Grew USD 52 into a USD 107,700 Portfolio

Currency Calculator