简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

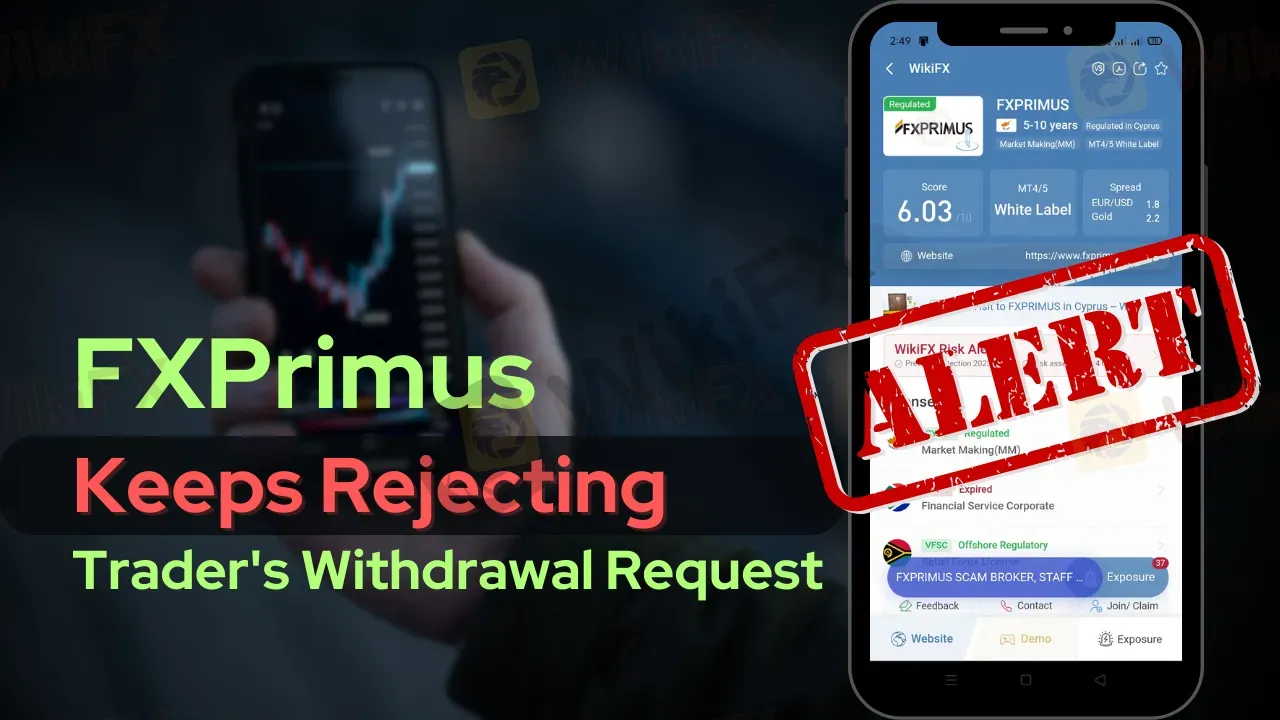

FXPrimus Keeps Rejecting Trader's Withdrawal Request

Abstract:FXPrimus faces criticism for repeatedly rejecting a trader's withdrawal requests. This raises concerns in the online trading community, emphasizing the importance of vigilance and awareness, even with regulated brokers.

In the vast realm of online trading, one would expect the process of withdrawal to be as seamless as that of depositing. However, this isn't always the case, as is evident from the recent troubles faced by an anonymous trader with FXPrimus.

FXPrimus Withdrawal Case

This trader, who reported the incident to WikiFX and prefers to remain nameless, faced repeated withdrawal rejection issues with FXPrimus, a matter of great concern for both seasoned and novice traders alike.

Trader's Withdrawal Attempts

October 19, 2023: The trader initiates a withdrawal request for a significant amount of USD 2,516. This was a well-earned profit, rightfully belonging to the trader. Yet, this withdrawal request met with an unexpected rejection by FXPrimus. The precise reasons for the rejection remain unclear, with the accompanying communication being an impersonal image, adding to the trader's anxiety.

October 20, 2023: Undeterred and hoping for a resolution, the trader tried another withdrawal request, this time for USD 2,000. To the trader's dismay, FXPrimus again denied this request as well. The increasing amount in limbo and back-to-back rejections are red flags that no trader should overlook.

Balance

Email Confirmation

Throughout this ordeal, the trader made multiple attempts to contact FXPrimus's customer service, seeking clarification, assistance, and most importantly, the release of the trapped funds. However, these efforts went in vain, with the trader receiving no substantial assistance.

On the other hand,

This is not the first case that WikiFX exposure has received. A lot of cases have been reported that are involved in withdrawal difficulties. (Cases shown below).

You can view all the reported cases through the link below:

https://www.wikifx.com/en/dealer/4051155469.html

FXPrimus Overview and Regulatory Status

FXPrimus is a forex broker that has been in the industry for several years. It offers online trading services to clients across various countries, providing access to a range of financial instruments, including currency pairs, commodities, indices, and more.

Regulatory Status

FXPrimus's regulatory status has varied over the years and may depend on the region in which it operates. As of my last update in November 2023, FXPrimus is an unregulated broker. And WikiFX has given this broker a alarmingly low score of 1.18/10.

Related Article

How to Resolve Withdrawal Issues with a Regulated Broker

The online trading world presents boundless opportunities. Yet, it's not without its challenges. A prime example is the withdrawal issues faced by a trader with FXPrimus, a regulated forex broker. Despite expectations for a smooth withdrawal process, many traders find themselves in complex situations, such as unexpected rejections. Here's a guide on avoiding such incidents and resolving issues with regulated brokers.

1. Understanding the Broker's Policies

Before trading, it's vital to acquaint yourself with the broker's terms and conditions, especially those regarding withdrawals. Look for any specific criteria, minimum withdrawal limits, or associated fees. Knowing these details can prevent misunderstandings or unexpected complications.

2. Maintain Proper Documentation

Keep records of all trading activities, transactions, and communication with the broker. Should you face any issues, this documentation will serve as evidence and help in conflict resolution.

3. Contact Customer Support Promptly

In the event of withdrawal problems, immediately reach out to the broker's customer support. Ensure your queries are detailed and straightforward. If one channel (like email) doesn't yield results, try others such as phone calls or live chats.

4. Check the Broker's Regulatory Status

Brokers like FXPrimus are regulated by authoritative bodies, ensuring they adhere to particular standards. It's crucial to confirm the broker's current regulatory status. A regulated broker typically offers better protection to traders. For instance, FXPrimus Europe (CY) Ltd was under the watchful eyes of CySEC. However, regulatory affiliations can change, so always stay updated.

5. Escalate If Necessary

If a satisfactory resolution isn't reached via customer support, consider escalating the issue. This might mean contacting the regulatory body overseeing the broker or seeking legal advice. Regulators often have mechanisms for addressing trader complaints.

6. Stay Updated and Share Experiences

Platforms like WikiFX compile reported issues about various brokers. Regularly checking these platforms and sharing your experiences can not only help you stay informed but also aid other traders in making informed decisions.

7. Diversify Brokers and Funds

Consider diversifying your investments across multiple brokers. By spreading funds, you reduce the risk associated with any single platform.

Related Article:

Awareness

The FXPrimus occurring issue specifically on issues of withdrawal, serves as a stark reminder for traders worldwide even if it is a regulated broker.

It emphasizes the importance of always being vigilant and informed about the platforms and brokers chosen for trading. While the world of online trading offers immense opportunities, it also comes with risks and challenges, especially when hard-earned money is at stake.

Another Related Article:

In Conclusion

The FXPrimus withdrawal issue is a wake-up call. It urges traders to be more cautious, aware, and prepared. It's essential to remember that in the digital age, staying informed and connected is the best defense against potential pitfalls in the world of online trading.

The trading world can be unpredictable. While regulated brokers like FXPrimus offer an added layer of protection, issues can still arise. By being proactive, informed, and vigilant, traders can better navigate the challenges and ensure their hard-earned profits are accessible when needed.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Fidelity Exposed: Traders Complain About Withdrawal Denials, Frozen Accounts & Platform Glitches

Does Fidelity Investments prevent you from accessing funds despite numerous assurances on your requests? Do you witness an account freeze by the US-based forex broker every time you request withdrawal access? Do you struggle with an unstable trading platform here? Is the slow Fidelity customer service making you face forced liquidation? These issues haunt traders, with many of them voicing their frustration on several broker review platforms such as WikiFX. In this Fidelity review article, we have shared quite a few complaints for you to look at. Read on!

Exposing The Trading Pit: Traders Blame the Broker for Unfair Withdrawal Denials & Account Blocks

Did you receive contradictory emails from The Trading Pit, with one approving payout and another rejecting it, citing trading rule violations? Did you purchase multiple trading accounts but receive a payout on only one of them? Did The Trading Pit prop firm refund you for the remaining accounts without clear reasoning? Did you face account bans despite using limited margins and keeping investment risks to a minimum? These are some raging complaints found under The Trading Pit review. We will share some of these complaints in this article. Take a look.

M&G Review: Traders Report Fund Scams, Misleading Market Info & False Return Promises

Applying for multiple withdrawals at M&G Investments but not getting it into your bank account? Do you see the uncredited withdrawal funds out of your forex trading account on the M&G login? Does the customer support service fail to address this trading issue? Does the misleading market information provided on this forex broker’s trading platform make you lose all your invested capital? Were you lured into investing under the promise of guaranteed forex returns? These issues have become highly common for traders at M&G Investments. In this M&G review article, we have echoed investor sentiments through their complaint screenshots. Take a look!

INZO Broker MT5 Review 2025: A Trader's Guide to Features, Fees and Risks

INZO is a foreign exchange (Forex) and Contracts for Difference (CFD) brokerage company that started working in 2021. The company is registered in Saint Vincent and the Grenadines and regulated offshore. It focuses on serving clients around the world by giving them access to popular trading platforms, especially MetaTrader 5 (MT5) and cTrader. The company offers different types of trading instruments, from currency pairs to cryptocurrencies. It aims to help both new and experienced traders. Read on to know more about it.

WikiFX Broker

Latest News

Forex Expert Recruitment Event – Sharing Insights, Building Rewards

Admirals Cancels UAE License as Part of Global Restructuring

Moomoo Singapore Opens Investor Boutiques to Strengthen Community

OmegaPro Review: Traders Flood Comment Sections with Withdrawal Denials & Scam Complaints

An Unbiased Review of INZO Broker for Indian Traders: What You Must Know

BotBro’s “30% Return” Scheme Raises New Red Flags Amid Ongoing Fraud Allegations

The 5%ers Review: Is it a Scam or Legit? Find Out from These Trader Comments

WikiEXPO Dubai 2025 Concludes Successfully — Shaping a Transparent, Innovative Future

2 Malaysians Arrested in $1 Million Gold Scam Impersonating Singapore Officials

Is FXPesa Regulated? Real User Reviews & Regulation Check

Currency Calculator