简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

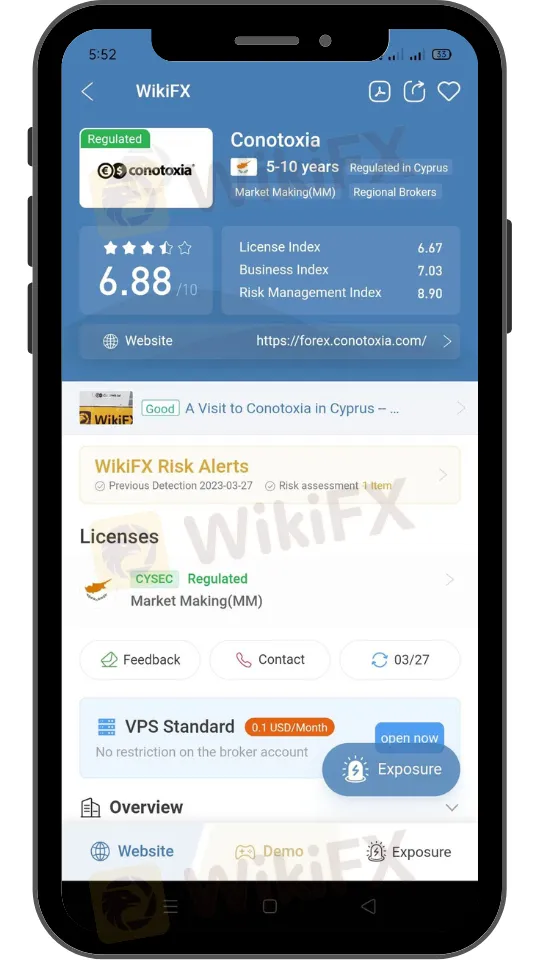

Retail Traders to Benefit from Conotoxia's Investment Advice Offering

Abstract:Conotoxia, the retail trading arm of Poland-based fintech Cinkciarz, has launched an investment advisory service with no entry barriers and a low threshold. It is the first company in the forex and contracts for the different industries to offer the product on a large scale. The service is available to retail traders from Europe and will provide individual investment recommendations on selected financial instruments.

Conotoxia, a retail trading platform under the Polish fintech company, Cinkciarz.pl, has launched a new investment advisory service with a low entry threshold for retail traders in Europe. The service provides individual investment recommendations on selected financial instruments and is available to traders without entry barriers and a minimum capital threshold. Conotoxia believes that this new service could revolutionize how retail brokers build their offerings.

Individualized Investment Advice for Retail Traders

Conotoxia is the first company in the foreign exchange (FX) and contracts for difference (CFD) industry to offer this product to traders on a large scale. The advisory service is not based on simple recommendations for the general public but is tailored to the needs of individual clients, the size of their portfolios, and their risk profiles. The investment advisor identifies opportunities and recommends appropriate moves, but the investor has complete control over the creation of their investment portfolio.

Accessible Investment Advice for European Retail Traders

Conotoxia's investment advice is aimed at European retail traders, specifically from the European Economic Area, including European Union countries, Iceland, Liechtenstein, and Norway. The service will be accessible via paid subscriptions, but the broker has prepared a promotion for users who sign up before June. They will have the chance to try the investment advice for free for a one-month trial period.

Conotoxia CEO, Grzegorz Jaworski, stated that the investment advisory service is a significant step in the development of the Invest & Forex segment and that the knowledge and experience of advisors can help clients build their own professional investment portfolios and make informed decisions. The company unveiled the new service at the Invest Cuffs 2023 conference held in Poland last weekend.

Expanding the Accessibility of Investment Advisory Services

Conotoxia wants to popularize investing with the support of professional advisors and make such services available to small investors. The company believes that investment advice could change individual investors' approach to investing. By providing investors with options to invest independently or with the support of an investment advisor, Conotoxia gives clients a broader package of services than its competitors.

About Conotoxia

Conotoxia is a Polish financial technology business that offers a variety of services such as foreign currency conversion, money transactions, payment handling, and internet dealing. Its currency conversion tool accepts a broad variety of currencies, including main currencies like USD, EUR, GBP, and JPY, as well as many foreign currencies. The website is simple to use and enables customers to conduct transactions swiftly and simply, with the option of locking in currency rates for future purchases.

Install the WikiFX App on your smartphone to stay updated on the latest news.

Download the app: https://social1.onelink.me/QgET/px2b7i8n

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

In-Depth Review of Stonefort Securities Withdrawals and Funding Methods – What Traders Should Really

For any experienced forex and CFD trader, the mechanics of moving capital are as critical as the trading strategy itself. The efficiency, security, and transparency of a broker's funding procedures form the bedrock of a trustworthy, long-term trading relationship. A broker can offer the tightest spreads and the most advanced platform, but if depositing funds is cumbersome or withdrawing profits is a battle, all other advantages become moot. This review provides a data-driven examination of Stonefort Securities withdrawals and funding methods. We will dissect the available information on payment options, processing times, associated costs, and the real-world user experience. Our analysis is anchored primarily in data from the global broker regulatory inquiry platform, WikiFX, supplemented by a critical look at publicly available information to provide a comprehensive and unbiased perspective for traders evaluating this broker.

MH Markets Deposits and Withdrawals Overview: A Data-Driven Analysis for Traders

For any experienced trader, the integrity of a broker is not just measured by its spreads or platform stability, but by the efficiency and reliability of its financial plumbing. The ability to deposit and, more importantly, withdraw capital without friction is a cornerstone of trust. This review provides an in-depth, data-driven analysis of the MH Markets deposits and withdrawals overview, examining the entire fund management lifecycle—from funding methods and processing speeds to fees and potential obstacles. MH Markets, operating for 5-10 years under the name Mohicans Markets (Ltd), has established a global footprint. With a WikiFX score of 7.08/10, it positions itself as a multi-asset broker offering a range of account types and access to the popular MetaTrader platforms. However, for a discerning trader, the real test lies in the details of its payment systems and the security of their funds. This article dissects the MH Markets funding methods withdrawal experience, leveraging pr

GAIN Capital Review: Exploring Complaints on Withdrawal Denials, Fake Return Promises & More

Is your forex trading experience with GAIN Capital full of financial scams? Does the broker disallow you from withdrawing your funds, including profits? Have you been scammed under the guise of higher return promises by an official? Does the GAIN Capital forex broker not have an effective customer support service for your trading queries? Concerned by this, many traders have shared negative GAIN Capital reviews online. In this article, we have discussed some of them. Read on!

Zenswealth Broker Review and Regulation Warning

Zenswealth Broker flagged as unregulated. FCA warns investors in latest review.

WikiFX Broker

Latest News

The 350 Per Cent Promise That Cost Her RM604,000

In-Depth Uniglobe Markets Commission Fees and Spreads Analysis – What Traders Should Really Know

WikiFX's New Evaluation of ATM Capital LTD: Does its License Protect the Arab Investor?

Is Axi Legit? A Data-Driven Analysis of Its Regulatory Standing and Trader Feedback

How a Fake Moomoo Ad Led to the “New Dream Voyage 5” Scam

FXPesa Review: Are Traders Facing High Slippage, Fund Losses & Withdrawal Denials?

Trive Investigation: High Score, Hidden Risk - The Profit Paradox

CMC Markets Australia Revenue Surges 34%, But High-Net-Worth Clients Face Tax Phishing Threat

"Just 9 More Lots": Inside the Endless Withdrawal Loop at Grand Capital

GCash Rolls Out Virtual US Account to Cut Forex Fees for Filipinos

Currency Calculator