简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Alert! Beware of the Scam Broker AstroFXC Trades

Abstract:This is proof that AstroFXC Trades is a scam broker and has been warned by the FCA, a major UK financial regulator.

Forex trading is one of the most convenient methods to make money from the comfort of your own home. Many scam brokers in the forex market operate without the approval of a financial body. One of the biggest, the UK watchdog FCA, has been disclosing banned corporations to raise public awareness.

A forex scam broker is an organization or person who may be running a fraudulent operation in the foreign exchange market. They may entice traders with false promises of large profits, manipulate transactions, attract advertisements, or steal money from traders' accounts. AstroFXC Trades is one example.

A Quick Overview of AstroFXC Trades

AstroFXC Trades is a fund management firm established in the United Kingdom (https://astrofxctrade.com/index.html). The broker promises to provide planned investing solutions with a greater rate of return in a variety of financial markets, including forex, stocks, and binary options. The business believes that consumers will choose an investment plan beginning with a $300 deposit and rising up to $50,000 and then wait a few weeks to get rewards. It diversifies customers' investment portfolios, according to the broker, to decrease risk exposure and boost return potential. It does not, however, discuss its regulatory status or if a financial compensation plan is in existence. If you want to join the broker, bitcoin is the sole accepted payment option. Customer service is available 24 hours a day, seven days a week by live chat, phone, and email.

Is the trading of AstroFXC regulated?

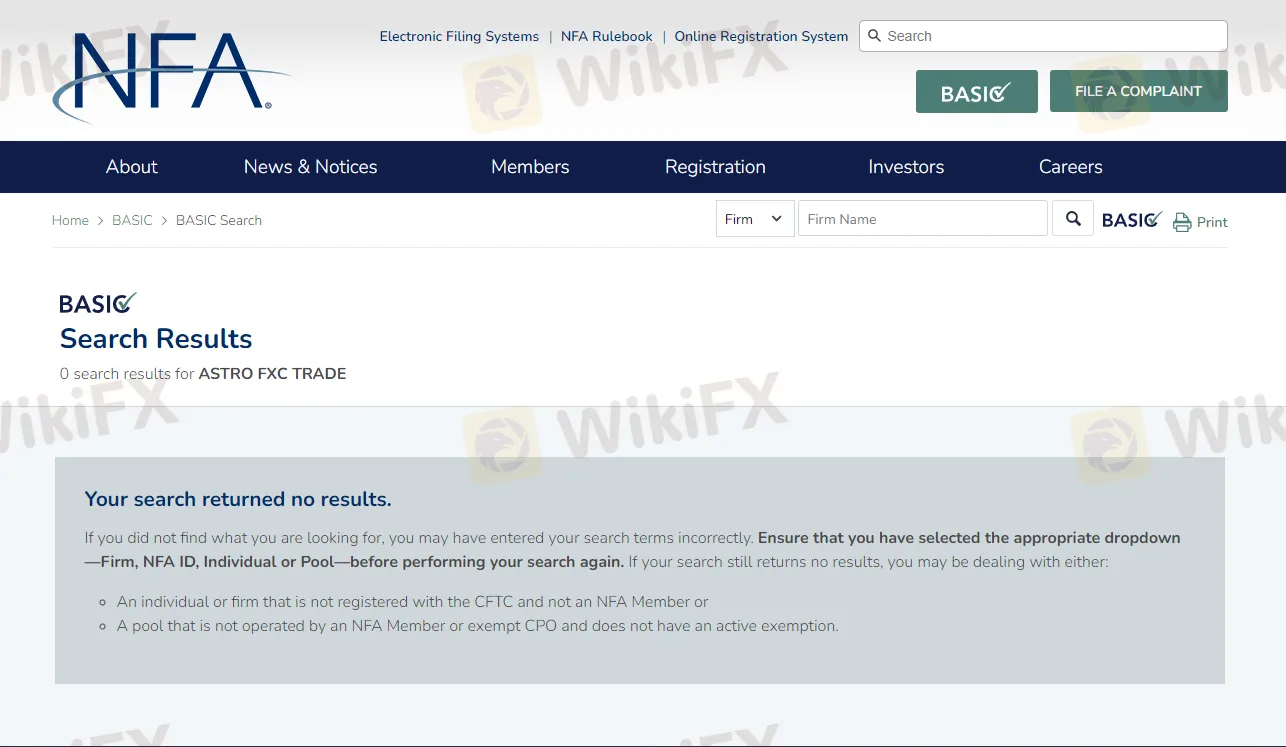

No! AstroFXC Trades is not a regulated entity. The firm is situated in the United Kingdom, according to the broker's website. Because all brokerage businesses must be registered with the Financial Conduct Authority (FCA) in order to operate, we investigated the British regulator's database for a match and found none.

Thus, the UK watchog FCA released a warning statement againts AstroFXC Trades.

What Made AstroFXC Trades a Scam Broker?

They are registered in the United States, according to their official website. The NFA, a significant financial body in the United States, does not have an account with AstroFXC Trades. In addition to the US SEC.gov

US SEC Gov

On the other hand,

WikiFX App as a medium platform of major financial authorities across the globe. Investigated and found that this broker hasn't registered even on a certain financial authority.

Aside from the firm's regulatory standing, they are confident on their official website to offer the client a set return based on the amount deposited. That is a complete fabrication. Losses are a component of the investment markets, and no investment firm can remain profitable indefinitely.

Final words

Before investing with any broker, do comprehensive research and due diligence on them, and be careful of red flags such as a lack of regulation, claims of assured returns, and unsolicited offers. If you feel a broker is a swindler, report them to the proper regulatory authorities and stop doing business with them.

Keep an eye out for more Forex scam news.

Install the WikiFX App on your smartphone to keep up to speed on current events.

Link to download: https://www.wikifx.com/en/download.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

CMC Markets Australia Revenue Surges 34%, But High-Net-Worth Clients Face Tax Phishing Threat

CMC Markets Australia reports a 34% revenue surge. Simultaneously, the company's high-net-worth clients are facing a serious tax-related phishing threat.

E TRADE Review: Traders Report Tax on Withdrawals, Poor Customer Service & Fund Scams

Has your E Trade forex trading account been charged a withholding tax fee? Did your account get blocked because of multiple deposits? Did you have to constantly call the officials to unblock your account? Failed to open a premium savings account despite submitting multiple documents? Is fund transfer too much of a hassle at E Trade? Did you find the E Trade customer support service not helpful? In this E Trade review article, we have shared certain complaints. Take a look!

mBank Exposed: Top Reasons Why Customers are Giving Thumbs Down to This Bank

Do you find mBank services too slow or unresponsive? Do you find your account getting blocked? Failing to access your account online due to several systemic glitches? Can’t perform the transactions on the mBank app? Do you also witness inappropriate stop-level trade execution by the financial services provider? You are not alone! Frustrated by these unfortunate circumstances, many of its clients have shared negative mBank reviews online. In this article, we have shared some of the reviews. Read on!

In-Depth Uniglobe Markets Commission Fees and Spreads Analysis – What Traders Should Really Know

For experienced traders, the cost of execution is a critical factor in broker selection. Low spreads, fair commissions, and transparent pricing can be the difference between a profitable and a losing strategy over the long term. This has led many to scrutinize the offerings of brokers like Uniglobe Markets, which presents a tiered account structure promising competitive conditions. However, a professional evaluation demands more than a surface-level look at marketing claims. It requires a deep, data-driven analysis of the real trading costs, set against the backdrop of the broker's operational integrity and safety. This comprehensive Uniglobe Markets commission fees and spreads analysis will deconstruct the broker's pricing model, examining its account types, typical spreads, commission policies, and potential ancillary costs. Using data primarily sourced from the global broker inquiry platform WikiFX, we will provide a clear-eyed view of the Uniglobe Markets spreads commissions prici

WikiFX Broker

Latest News

WikiFX's New Evaluation of ATM Capital LTD: Does its License Protect the Arab Investor?

How a Fake Moomoo Ad Led to the “New Dream Voyage 5” Scam

Is Axi Legit? A Data-Driven Analysis of Its Regulatory Standing and Trader Feedback

Trive Investigation: High Score, Hidden Risk - The Profit Paradox

In-Depth Uniglobe Markets Commission Fees and Spreads Analysis – What Traders Should Really Know

FXPesa Review: Are Traders Facing High Slippage, Fund Losses & Withdrawal Denials?

CMC Markets Australia Revenue Surges 34%, But High-Net-Worth Clients Face Tax Phishing Threat

Bessent believes there won't be a recession in 2026 but says some sectors are challenged

Young Singaporean Trader Grew USD 52 into a USD 107,700 Portfolio

Is GGCC Legit? A Data-Driven Analysis for Experienced Traders

Currency Calculator