简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Breaking: FTX Hacked: $1bn Drained from FTX and FTX US Accounts So Far

Abstract:The hack came just hours after Sam Bankman-Fried resigned as CEO Speculation is rife of an 'inside job'

The FTX drama continues.

Take Advantage of the Biggest Financial Event in London. This year we have expanded to new verticals in Online Trading, Fintech, Digital Assets, Blockchain, and Payments.Just hours after FTX crypto exchange filed for Chapter 11 bankruptcy and Sam Bankman-Fried resigned as CEO, over $600 million disappeared from FTX wallets within a matter of hours with no explanation as to why.

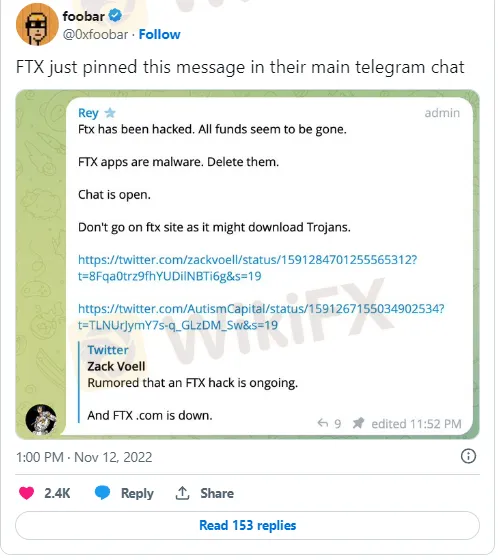

Amid the Friday night confusion, there was speculation that the draining of wallets into a single account was the action of a liquidator or even a regulator. However, shortly after, it was confirmed on the FTX official Telegram channel (now pinned by FTX General Counsel Ryne Miller) that the hundreds of millions of dollars being siphoned off was indeed the action of a hack, as the FTX.com website came offline.

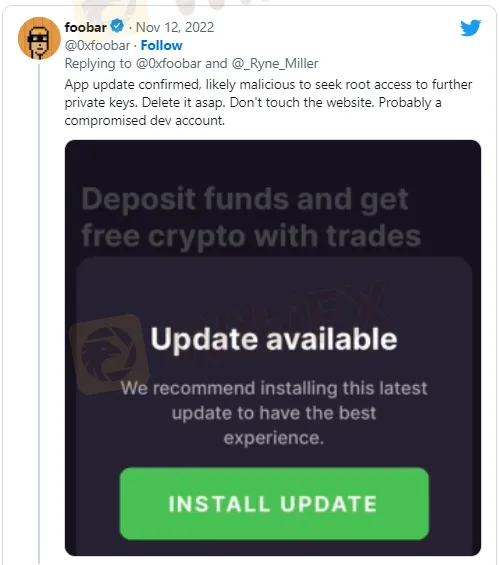

Both FTX and FTX US appear to be affected by what is speculated to be the result of a Trojan, with users of both exchanges reporting balances of $0 in their accounts. Reports are emerging of SMS messages and emails being sent by FTX to customers to log into the app and website, which are infected with a trojan and enabled the hack.

Hack or Rug Pull?

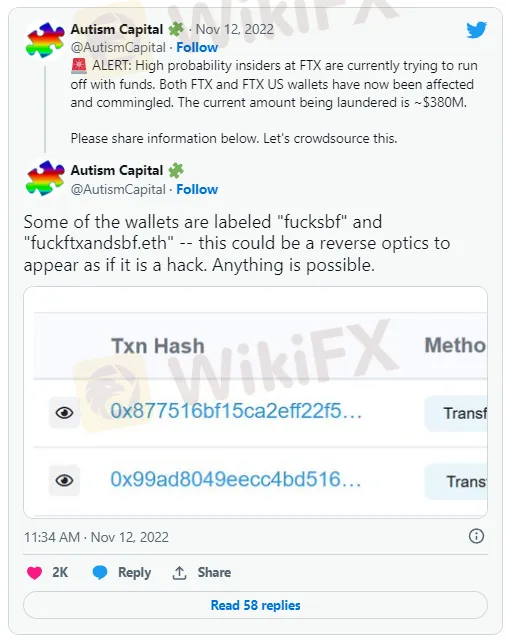

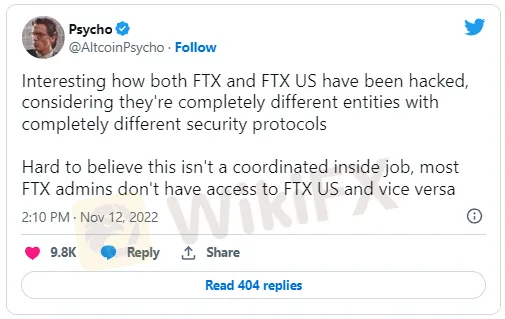

With the attack and account draining appearing to be ongoing at the time of writing, speculation is rife on what is happening and where the money is going. Accusations of an 'inside job' quickly gathered steam on social media.

It does not take Sherlock Holmes to link the draining of accounts to the recently resigned CEO, Sam Bankman-Fried who took to Twitter on Thursday to explain and apologize for his actions. Twitter sleuths were quick to point out why they thought it “hard to believe this isn't a coordinated inside job.”

With the attack understood to be ongoing and details emerging all the time, approximately $1 billion is believed to be drained so far. All FTX and FTX US users are being advised NOT to visit the app or website and delete the app altogether.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

CMC Markets Australia Revenue Surges 34%, But High-Net-Worth Clients Face Tax Phishing Threat

CMC Markets Australia reports a 34% revenue surge. Simultaneously, the company's high-net-worth clients are facing a serious tax-related phishing threat.

E TRADE Review: Traders Report Tax on Withdrawals, Poor Customer Service & Fund Scams

Has your E Trade forex trading account been charged a withholding tax fee? Did your account get blocked because of multiple deposits? Did you have to constantly call the officials to unblock your account? Failed to open a premium savings account despite submitting multiple documents? Is fund transfer too much of a hassle at E Trade? Did you find the E Trade customer support service not helpful? In this E Trade review article, we have shared certain complaints. Take a look!

mBank Exposed: Top Reasons Why Customers are Giving Thumbs Down to This Bank

Do you find mBank services too slow or unresponsive? Do you find your account getting blocked? Failing to access your account online due to several systemic glitches? Can’t perform the transactions on the mBank app? Do you also witness inappropriate stop-level trade execution by the financial services provider? You are not alone! Frustrated by these unfortunate circumstances, many of its clients have shared negative mBank reviews online. In this article, we have shared some of the reviews. Read on!

In-Depth Uniglobe Markets Commission Fees and Spreads Analysis – What Traders Should Really Know

For experienced traders, the cost of execution is a critical factor in broker selection. Low spreads, fair commissions, and transparent pricing can be the difference between a profitable and a losing strategy over the long term. This has led many to scrutinize the offerings of brokers like Uniglobe Markets, which presents a tiered account structure promising competitive conditions. However, a professional evaluation demands more than a surface-level look at marketing claims. It requires a deep, data-driven analysis of the real trading costs, set against the backdrop of the broker's operational integrity and safety. This comprehensive Uniglobe Markets commission fees and spreads analysis will deconstruct the broker's pricing model, examining its account types, typical spreads, commission policies, and potential ancillary costs. Using data primarily sourced from the global broker inquiry platform WikiFX, we will provide a clear-eyed view of the Uniglobe Markets spreads commissions prici

WikiFX Broker

Latest News

WikiFX's New Evaluation of ATM Capital LTD: Does its License Protect the Arab Investor?

How a Fake Moomoo Ad Led to the “New Dream Voyage 5” Scam

Is Axi Legit? A Data-Driven Analysis of Its Regulatory Standing and Trader Feedback

Trive Investigation: High Score, Hidden Risk - The Profit Paradox

In-Depth Uniglobe Markets Commission Fees and Spreads Analysis – What Traders Should Really Know

FXPesa Review: Are Traders Facing High Slippage, Fund Losses & Withdrawal Denials?

CMC Markets Australia Revenue Surges 34%, But High-Net-Worth Clients Face Tax Phishing Threat

Bessent believes there won't be a recession in 2026 but says some sectors are challenged

mBank Exposed: Top Reasons Why Customers are Giving Thumbs Down to This Bank

Young Singaporean Trader Grew USD 52 into a USD 107,700 Portfolio

Currency Calculator