简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Trade With Caution: How Does FxCitizen Defraud Clients?

Abstract:The forex market is massive and involves trillions of dollars traded each day. Such a huge volume of transactions attracts scammers from every nook and corner of the world.

On top of that, increasing numbers of brokers make it even more challenging to find a legitimate broker. This piece discusses how shabby brokers like FxCitizen can scam you by luring you into unrealistic profitable deals. We'll also let you know how to avoid scam brokers.

Quick overview

Founded in 2010, FxCitizen(https://fxcitizen.com/) is an offshore broker based in Vanuatu. The broker provides trading services in forex, indices, and commodities. Other features include different account types, multiple payment options and a trading platform MT5 powered by MetaQuotes. The company entices clients with special bonus offers and cash rebates. Moreover, the broker hosts monthly lucky draws, trading contests and promises fake rewards.

Is FxCitizen regulated?

No, FxCitizen (https://fxcitizen.com/) is not regulated anywhere in the world. The company doesn't even hold registration with any well-known supervisory authority.

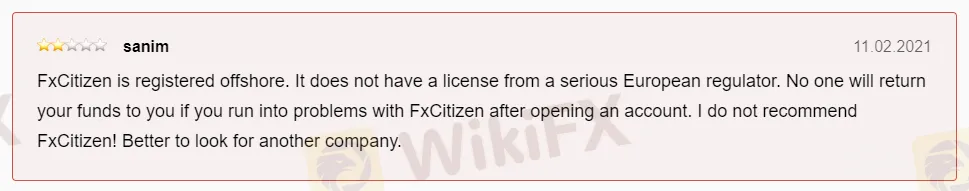

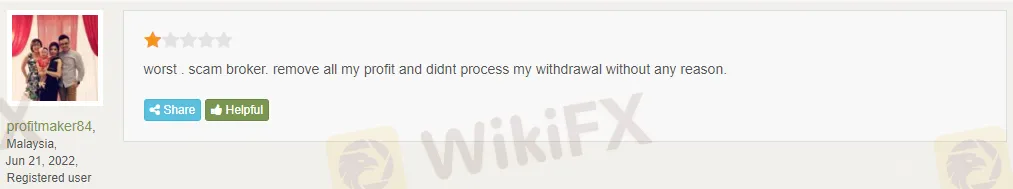

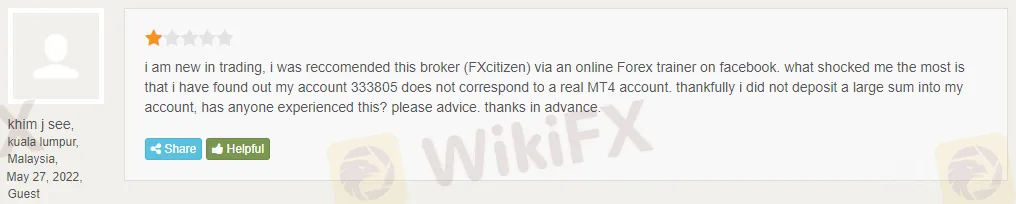

Clientele feedback

FxCitizen holds poor clientele feedback. The company has been accused of multiple issues, including price manipulation, account closures, withdrawal problems, customer support, etc. People have reported the broker's lousy code of conduct on several independent reviewers' portals, including BrokersView. Let us share some screenshots below.

How FxCitizen defraud clients?

FxCitizen marketing agents get connected with clients who attempt to register an account with the company. They pretend to be their account manager, ask them to fund their accounts and keep pushing them unless they do so. Usually, newbies who haven't been exposed to such tactics before become their prey.

Once clients add funds to their accounts, the company barely care about them anymore. It stops answering clients' phone calls and replying to their email messages. The firm doesn't process clients' withdrawal requests either. Clients have also reported that the company manipulates their trades and sometimes even blocks access to their trading accounts.

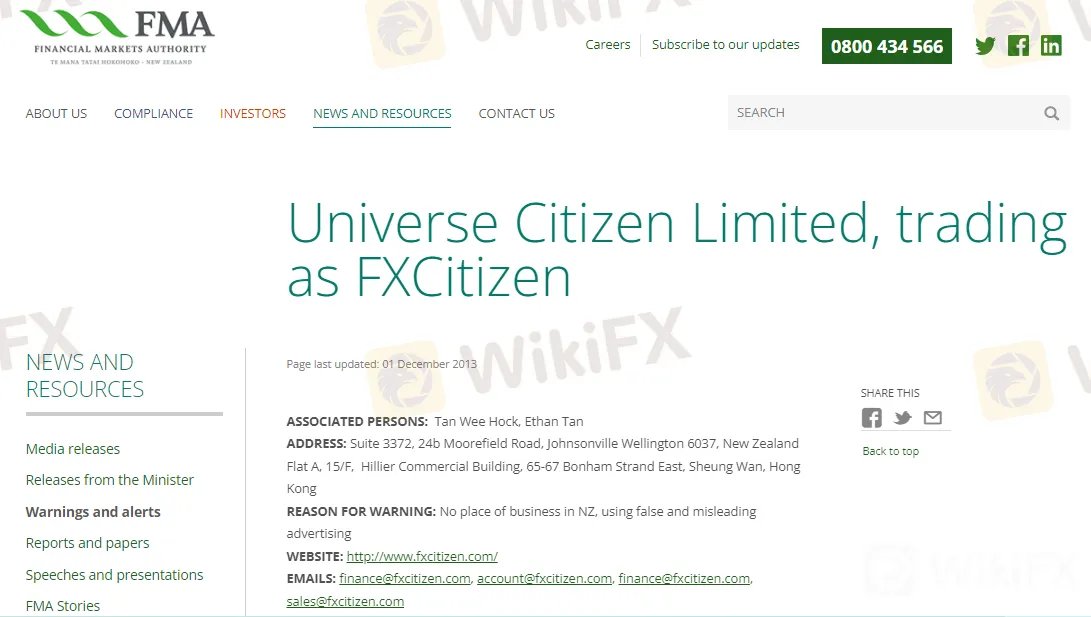

Notably, the broker has been warned by the Financial Markets Authority (FMA) New Zealand because of projecting misleading information.

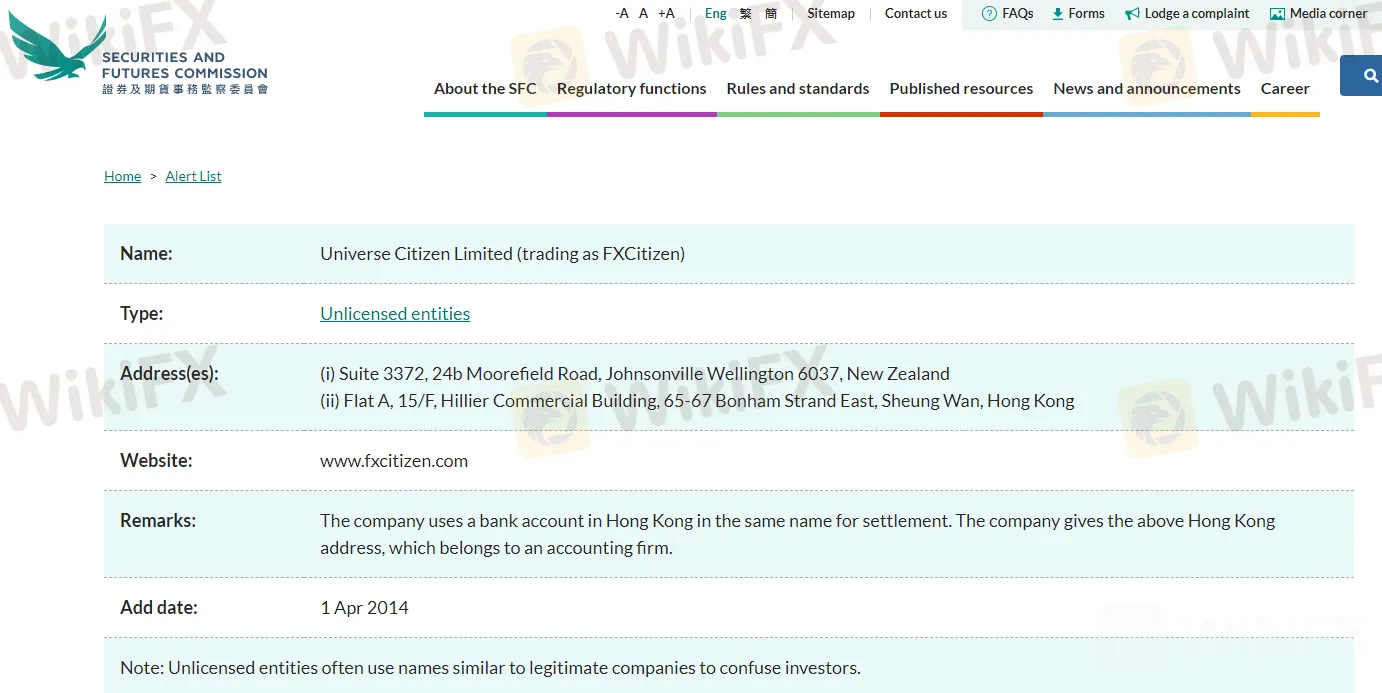

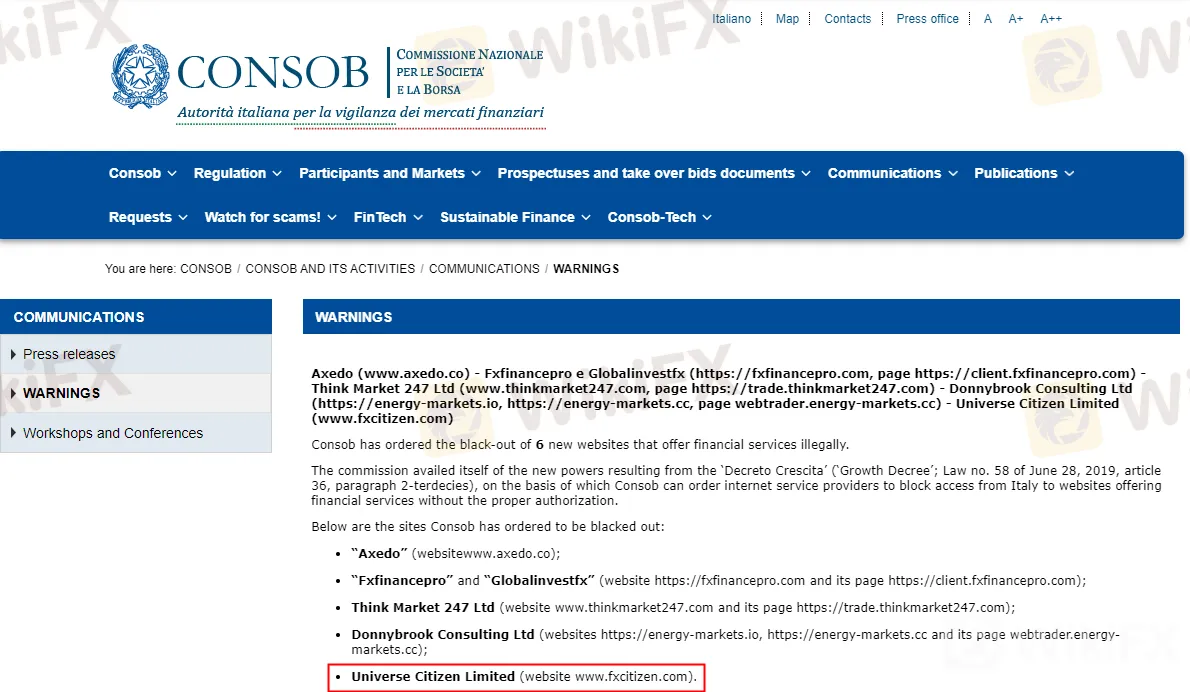

The Securities and Futures Commission in Hong Kong(SFC) also added the company to “Alert List” and the Italian Companies and Exchange Commission(CONSOB) also warned public that the broker offers financial services illegally.

What to do if I already have deposited funds with FxCitizen?

Being an existing client, you can only initiate a withdrawal request with the company. The broker is unlikely to process your withdrawals, not for big amounts at least. Therefore, try recovering your funds in small chunks. You might incur a higher withdrawal fee, but it is still worth it if you can get your funds back.

How to avoid signing up with scam brokers like FxCitizen?

First, make sure that you open an account with a regulated broker. Secondly, it should be a reputable entity. Remember, you can't start making thousands of dollars overnights in a highly volatile market like forex. Therefore, if someone promises unrealistic returns, believe it to be a scammer. Avoid paying any heed to such offers and refuse them straight away.

Bottom line

Although it is not always true for an unregulated broker to be a scam, precautions are still necessary. There is no use in crying over spilt milk, so better to proceed with care. A reputable regulated broker is always better than signing up with a non-regulated entity.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

CMC Markets Australia Revenue Surges 34%, But High-Net-Worth Clients Face Tax Phishing Threat

CMC Markets Australia reports a 34% revenue surge. Simultaneously, the company's high-net-worth clients are facing a serious tax-related phishing threat.

E TRADE Review: Traders Report Tax on Withdrawals, Poor Customer Service & Fund Scams

Has your E Trade forex trading account been charged a withholding tax fee? Did your account get blocked because of multiple deposits? Did you have to constantly call the officials to unblock your account? Failed to open a premium savings account despite submitting multiple documents? Is fund transfer too much of a hassle at E Trade? Did you find the E Trade customer support service not helpful? In this E Trade review article, we have shared certain complaints. Take a look!

mBank Exposed: Top Reasons Why Customers are Giving Thumbs Down to This Bank

Do you find mBank services too slow or unresponsive? Do you find your account getting blocked? Failing to access your account online due to several systemic glitches? Can’t perform the transactions on the mBank app? Do you also witness inappropriate stop-level trade execution by the financial services provider? You are not alone! Frustrated by these unfortunate circumstances, many of its clients have shared negative mBank reviews online. In this article, we have shared some of the reviews. Read on!

In-Depth Uniglobe Markets Commission Fees and Spreads Analysis – What Traders Should Really Know

For experienced traders, the cost of execution is a critical factor in broker selection. Low spreads, fair commissions, and transparent pricing can be the difference between a profitable and a losing strategy over the long term. This has led many to scrutinize the offerings of brokers like Uniglobe Markets, which presents a tiered account structure promising competitive conditions. However, a professional evaluation demands more than a surface-level look at marketing claims. It requires a deep, data-driven analysis of the real trading costs, set against the backdrop of the broker's operational integrity and safety. This comprehensive Uniglobe Markets commission fees and spreads analysis will deconstruct the broker's pricing model, examining its account types, typical spreads, commission policies, and potential ancillary costs. Using data primarily sourced from the global broker inquiry platform WikiFX, we will provide a clear-eyed view of the Uniglobe Markets spreads commissions prici

WikiFX Broker

Latest News

In-Depth Uniglobe Markets Commission Fees and Spreads Analysis – What Traders Should Really Know

WikiFX's New Evaluation of ATM Capital LTD: Does its License Protect the Arab Investor?

Is Axi Legit? A Data-Driven Analysis of Its Regulatory Standing and Trader Feedback

How a Fake Moomoo Ad Led to the “New Dream Voyage 5” Scam

FXPesa Review: Are Traders Facing High Slippage, Fund Losses & Withdrawal Denials?

Trive Investigation: High Score, Hidden Risk - The Profit Paradox

CMC Markets Australia Revenue Surges 34%, But High-Net-Worth Clients Face Tax Phishing Threat

Young Singaporean Trader Grew USD 52 into a USD 107,700 Portfolio

Is GGCC Legit? A Data-Driven Analysis for Experienced Traders

E TRADE Review: Traders Report Tax on Withdrawals, Poor Customer Service & Fund Scams

Currency Calculator