简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How to Locate Short Selling and Why?

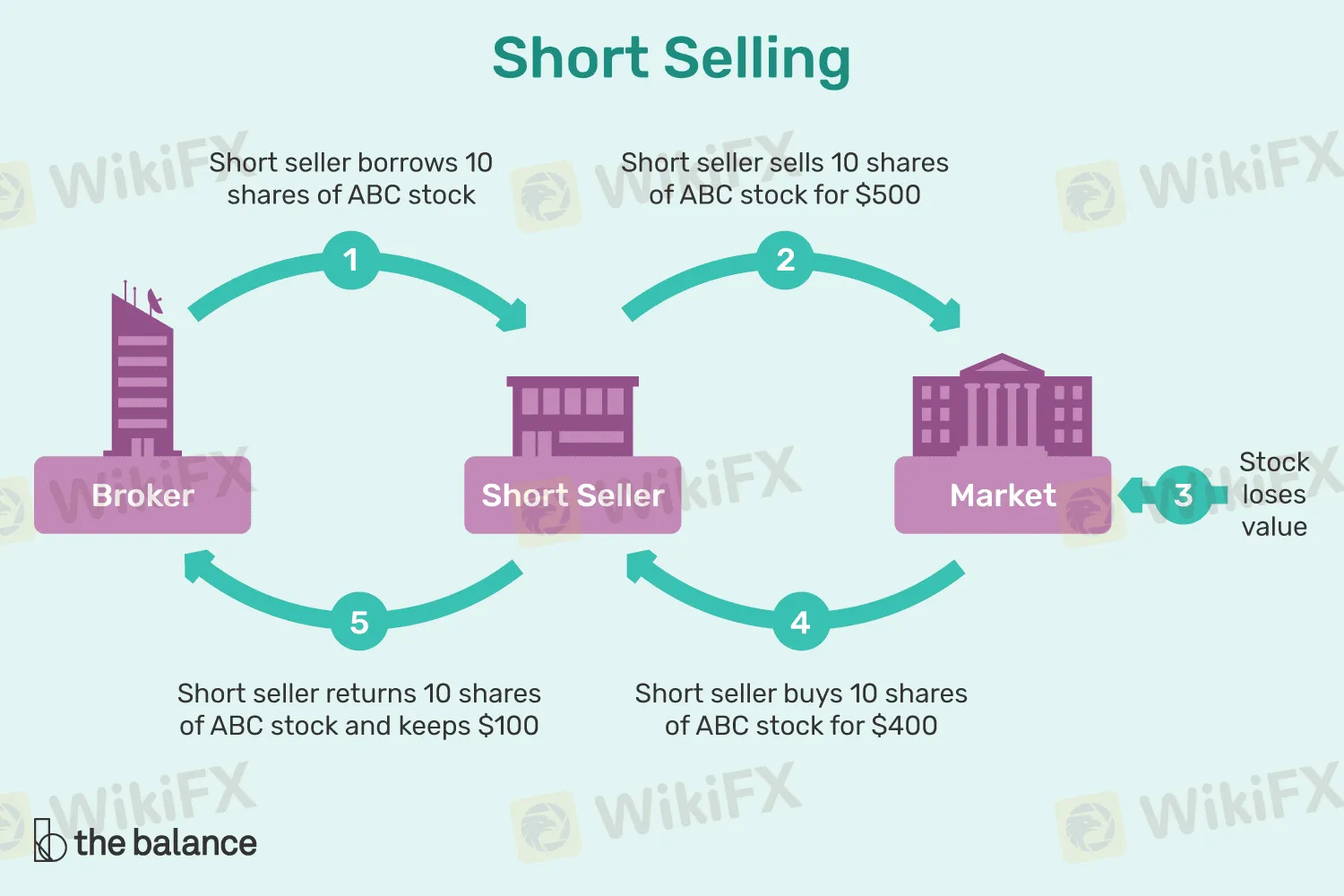

Abstract:Traders choose short selling because it is interesting to speculate and hedge. To speculate means creating a pure price bet for it would decline in the future. If the speculation is wrong, they should buy shares at a loss or higher.

Due to the use of margin in the short selling, the conduct is over a short time period, thus it is near to act of speculation. In addition, there are also people who do short selling to hedge a long position.

The example would be, if you are in the long positions you might aim to sell short against the long position to lock your profit in case you face loss. This is similar to a situation where you limit downside losses in the long position. If you want to create a profit in short selling position, you should consider this scenario. You trade at $50 for instance that would decline in price for the next few months. They would borrow 100 shares then sell them to other investors. So, the trader now short 100 shares to sell something they borrow or not they have. Short selling is possible only when you borrow the shares. So, it is not available sometimes, especially during the situation where traders flock for it.

Less than a month later, the company whose shares are borrowed announced the dismal financial condition, thus the stock fell to around $40. On this occasion, the trader would decide to close this short position and buy the 100 shares at $40 to replace borrowed shares. This is to note that this replacement of the borrowed shares do not include the commissions and margin account charge. The calculation is $1,000: ($50 – $40 = $10 x 100 shares = $1000, said Investopedia.

But it does not mean that it is not prone to failing. Imagine a trader did not close out the short position of the $40, but leave it open for further decline. Then, a competitor enters acquiring the company for $65 takeover per shares. Then, the trader encounters loss. Thus, trader might need to buy back the shares at the higher price.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Seaprimecapitals Withdrawal Problems: A Complete Guide to Risks and User Experiences

Worries about Seaprimecapitals withdrawal problems and possible Seaprimecapitals withdrawal delay are important for any trader. Being able to get your money quickly and reliably is the foundation of trust between a trader and their broker. When questions come up about this basic process, it's important to look into what's causing them. This guide will tackle these concerns head-on, giving you a clear, fact-based look at Seaprimecapitals' withdrawal processes, user experiences, and trading conditions. Most importantly, we'll connect these real-world issues to the single most important factor behind them: whether the broker is properly regulated. Understanding this connection is key to figuring out the real risk to your capital and making a smart decision.

iFX Brokers Review: Do Traders Face Withdrawal Issues, Deposit Credit Failures & Free Coupon Mess?

Have you had to pay several fees at iFX Brokers? Had your trading profit been transferred to a scamming website, causing you losses? Failed to receive withdrawals from your iFX Brokers trading account? Has your deposit failed to reflect in your trading account? Got deceived in the name of a free coupon? Did the broker officials not help you in resolving your queries? Your problems resonate with many of your fellow traders at iFX Brokers. In this iFX Brokers review article, we have explained these problems and attached traders’ screenshots. Read on!

NinjaTrader Exposed: Why Traders are Calling Out NinjaTrader’s Lifetime Plan & Chart Data

Did NinjaTrader onboard you in the name of the Lifetime Plan, but its ordinary customer service left you in a poor trading state? Do you witness price chart-related discrepancies on the NinjaTrader app? Did you have to go through numerous identity and address proof checks for account approval? These problems occupy much of the NinjaTrader review online. In this article, we have discussed these through complaint screenshots. Take a look!

Questrade Review Pros, Cons and Regulation

Is Questrade legit? Yes—CIRO regulated broker offering stocks, ETFs, forex, CFDs, bonds, and more with low fees and modern platforms.

WikiFX Broker

Latest News

Simulated Trading Competition Experience Sharing

WinproFx Regulation: A Complete Guide to Its Licensing and Safety for Traders

Interactive Brokers Expands Access to Taipei Exchange

Axi Review: A Data-Driven Analysis for Experienced Traders

INZO Regulation and Risk Assessment: A Data-Driven Analysis for Traders

Questrade Review Pros, Cons and Regulation

AccentForex Review: Is It Safe to Invest or Scam?

Cleveland Fed's Hammack supports keeping rates around current 'barely restrictive' level

Delayed September report shows U.S. added 119,000 jobs, more than expected; unemployment rate at 4.4%

The CMIA Capital Partners Scam That Cost a Remisier Almost Half a Million

Currency Calculator