简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX VPS Ranks Your Trading Environment

Abstract:Some people complain that their forex trading platform is unstable and there is downtime resulting in the inability to close their positions. This article will introduce a new WikiFX function that allows you to inspect the stability of your trading environment.

Choosing a regulated and safe forex broker is a prerequisite for a stable trading environment as many fraudulent brokers leverage off a poorly maintained trading environment to capitulate their clients' accounts. However, this does not mean that reliable brokers can provide a high level of stability as many factors can affect an online trading environment.

The stability of the platform directly affects whether your transactions can be carried out properly, whether you can accurately place orders and close positions promptly and how much transaction a trader/investor is paying.

This article is specially written to introduce WikiFX's Trading Environment Ranking tool (https://cloud.wikifx.com/en/data/EnvRanking.html) which will conveniently evaluate and rank your trading environment. These results were collected over time with over 55,000 participants with over 4 million transactions that have an accumulated occupancy margin of approximately 330 million USD.

Source: WikiFX

This is an example to demonstrate how WikiFX evaluates a broker's trading platform. The broker used in this example is Forex.com – for more information about this broker, log on to https://www.wikifx.com/en/dealer/0001378443.html.

WikiFX's VPS will examine 4 different aspects of a trading environment, which are transaction speed, trading slippage, transaction cost, rollover cost, and disconnection rating, before benchmarking the selected brokers with their industry peers.

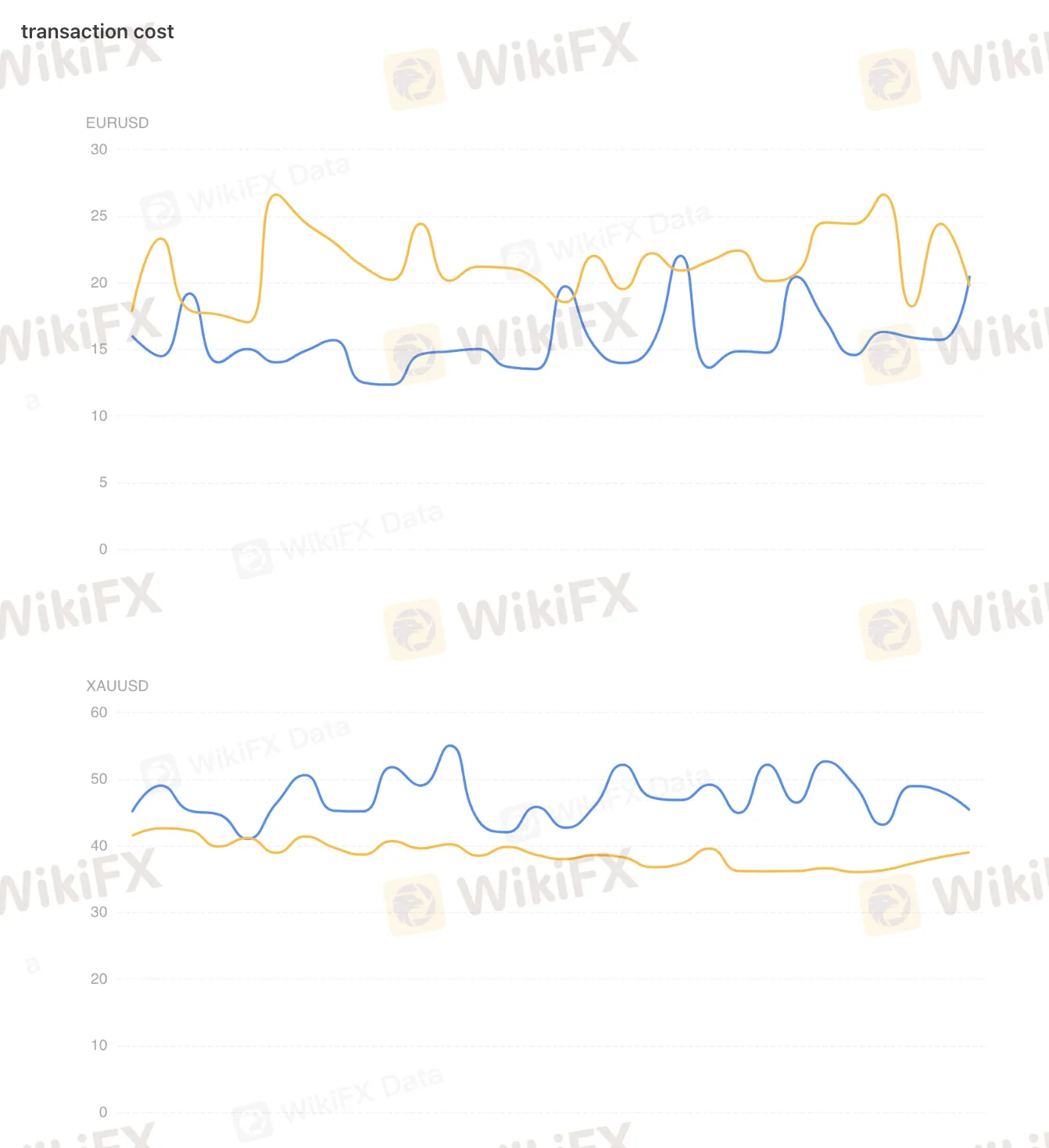

Blue line represents Forex.com; Orange line represents the industry benchmark

(i) The transaction speed is measured by reviewing the below components:

Average transaction speed (ms)

The fastest transaction speed (ms)

The fastest speed of opening positions (ms)

The fastest speed of closing positions (ms)

Slowest transaction speed (ms)

The slowest speed of opening positions (ms)

The slowest speed of closing positions (ms)

(ii) Trading slippage is measured by inspecting these 4 areas:

Average slippage

Maximum transaction slippage

Maximum position slippage

Maximum negative slippage

(iii) Transaction costs are calculated from the average transaction cost of main currency pairs, for example, EUR/USD and XAU/USD.

(iv) The rollover cost ranking is calculated from the cost of holding an overnight trade of main currency pairs, for example, EUR/USD and XAU/USD.

(v) Software disconnection is one of the most frustrating incidents that a trader could occur especially when the market is having fairly high volatility. In this case, it is measured by the average disconnection frequency (times/day) and average reconnection time (millisecond/per request).

If you wish to compare several brokers of your choice, you could click the blue button as shown in the image above and select the names of those brokers.

WikiFXs VPS enables you to compare up to 5 brokers simultaneously and provides detailed insights about their trading environments.

Through this, you could easily avoid brokers that do not have a stable system because making profits from the currency markets is hard enough, the last thing you need are technical issues that could turn your running profits into losses in just a blink of the eye.

It is important to note that finding the most reliable broker should be the utmost priority for a trader and/or investor - before you start evaluating its trading environment. Head over to WikiFXs official website www.wikifx.com or download the free WikiFX mobile app on Google Play and App Store right now to find the trustworthy forex broker for you in every aspect.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

IG Group Expands French Stock Trading with Upvest

IG Group partners with Upvest to launch stock and ETF trading in France, boosting its European expansion amid rising broker competition.

Switch Markets Review: Do Traders Face Deposit Discrepancies and Account-related Issues?

Do you fail to deposit your funds into the Switch Markets forex trading account? Earned profits, withdrew them too, but did Switch Markets block your deposits? Wanted to close your trading account due to payment-related issues, but in turn got your emails blocked by the Australia-based forex broker? Faced a negative trading account balance because of illegitimate trade order execution? Many traders have shared these stories about Switch Markets on broker review platforms. In this Switch Markets review article, we have mentioned the same. Read on!

Is IEXS Safe or a Scam? A 2025 Review Based on 13 User Complaints and Regulatory Red Flags

You're asking a direct and important question: Is IEXS safe or a scam? As someone who might trade with them or already does, this is the most important research you can do. While IEXS says it is a global broker with over ten years of experience, a detailed look at its regulatory status and many user reviews shows serious warning signs that cannot be ignored. The evidence suggests a high-risk situation for traders' capital. This review will examine the available information, from official regulatory warnings to concerning first-hand user complaints, to give you a clear and fact-based view of the risks involved in trading with IEXS. Our goal is to give you the facts you need to make a smart decision.

Having Trouble Getting Your Funds Out of IEXS? A Simple Guide to Delays and Solutions

Are you having trouble withdrawing funds from your IEXS account or facing delays getting your funds? Not being able to access your own capital is one of the most stressful situations any trader can face. It breaks down your basic trust with a broker. This isn't just annoying - it's a serious problem that can mess up your financial plans and cause a lot of worry. This guide goes beyond basic advice. We'll look at real user experiences and official regulatory information to give you clear answers. Our goal is to help you understand why IEXS withdrawal problems happen and show you practical steps you can take. We understand your concerns and want to give you the information you need to handle this tough situation.

WikiFX Broker

Latest News

Trillium Financial Broker Exposed: Top Reasons Why Traders are Losing Trust Here

FIBO Group Ltd Review 2025: Find out whether FIBO Group Is Legit or Scam?

Amillex Withdrawal Problems

Is INGOT Brokers Safe or Scam? Critical 2025 Safety Review & Red Flags

150 Years Of Data Destroy Democrat Dogma On Tariffs: Fed Study Finds They Lower, Not Raise, Inflation

CQG Partners with Webull Singapore to Power the Broker’s New Futures Trading Offering

【WikiEXPO Global Expert Interviews】Ashish Kumar Singh: Building a Responsible and Interoperable Web3

Trump: India\s US exports jump despite 50% tariffs as trade tensions ease

IEXS Review 2025: A Complete Expert Analysis

CySEC Flags 21 Unauthorized Broker Websites in 2025 Crackdown

Currency Calculator