简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

When is China CPI and how might it affect AUD?

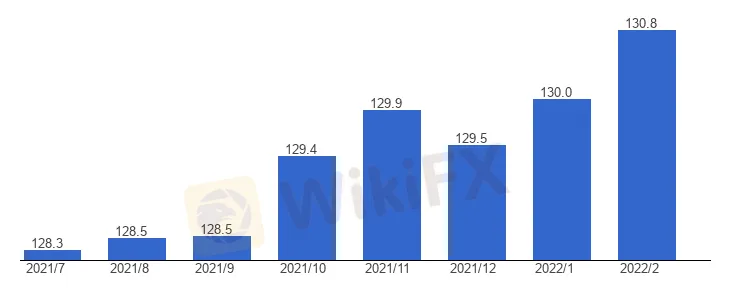

Abstract:'Elevated commodity prices are set to buoy China producer inflation in March but the pass through to consumer prices is still limited,'' analysts at Westpac said in anticipation of today's data from China.

The Chinese Consumer Price Index and Producer Price Index, released by the National Bureau of Statistics of China, are due at 01:30 GMT on Monday.

Meanwhile, the economic toll that coronavirus is having will be a concern in financial markets. Shanghai has been under lockdown since 28 March. The city of 26 million people reported 1,006 confirmed infections and almost 24,000 asymptomatic cases over the previous 24 hours with the 23,107 total reported for China on April 7. Indeed, Omricon will be expected to deal a big blow to China's economy. The most recent hard numbers on Chinas economy refer to January and February which are dated given the war in Ukraine, oil prices surging as well as a new jet of covid-19 cases.

How will AUD react?

The price of AUD that trades as a proxy to Chinese economic events, would come under pressure in light of a worsening outlook for the Chinese economy. The data today, could hurt the Aussie with the risks of stagflation. Inflation in China has failed to pick up this year so far with the continually high PPI and growing raw material prices weighing on firms while the low CPI data reflects the present sluggish domestic demand. AUD/USD is already under pressure on Monday, down 0.2% with 30 minutes to go to the release of the data.

About China CPI

The Consumer Price Index is released by the National Bureau of Statistics of China. It is a measure of retail price variations within a representative basket of goods and services. The result is a comprehensive summary of the results extracted from the urban consumer price index and rural consumer price index. The purchase power of the CNY is dragged down by inflation.

The CPI is a key indicator to measure inflation and changes in purchasing trends. A substantial consumer price index increase would indicate that inflation has become a destabilizing factor in the economy, potentially prompting The Peoples Bank of China to tighten monetary policy and fiscal policy risk. Generally speaking, a high reading is seen as positive (or bullish) for the CNY, while a low reading is seen as negative (or Bearish) for the CNY.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Prop Firm Tradeify Signs ‘The Nuke’ as Global Brand Ambassador

Miami-based prop trading firm Tradeify has officially announced a major long-term partnership with Luke “The Nuke” Littler, the current World Number 1 and reigning 2024/2025 PDC Darts World Champion. Littler joins Tradeify as its new Global Brand Ambassador, marking one of the company’s most significant branding investments to date.

【WikiEXPO Global Expert Interviews】Sheikh Muhammad Noman: The Future of Investment in the GCC

As WikiEXPO Dubai concludes successfully, we had the pleasure of interviewing Sheikh Muhammad Noman, the Founder and CEO of Pegasus Capital, brings over 20 years of profound expertise as an Investment Professional. He specializes in investment securities, risk calculations, financial engineering, and structuring business models with minimal risk. As a Founder and Business Development Partner, he oversees diversified investment and business portfolios for leading family offices throughout the GCC region, with a focus on sectors such as green energy, digital assets, and finance. His deep understanding of financial markets has been instrumental in crafting strategic investment solutions that significantly enhance portfolio performance.

Close Up With WikiFX —— Take A Close Look At Amillex

With the rapid growth of global multi-asset investment markets, the differences among regional forex markets have become increasingly significant. As a forex broker information service platform operating in more than 180 countries and regions, WikiFX is dedicated to helping investors in every market identify reliable brokers. Therefore, we have launched an exclusive interview series —— "Close Up With WikiFX", offering in-depth conversations with local brokers. This series aims to dive deep into frontline markets and provide first-hand information, helping investors gain a clearer and more comprehensive understanding of quality brokers.

Seacrest Markets Exposed: Are You Facing Payout Denials and Spread Issues with This Prop Firm?

Seacrest Markets has garnered wrath from traders owing to a variety of reasons, including payout denials for traders winning trading challenges, high slippage causing losses, the lack of response from the customer support official to address withdrawal issues, and more. Irritated by these trading inefficiencies, a lot of traders have given a negative review of Seacrest Markets prop firm. In this article, we have shared some of them. Take a look!

WikiFX Broker

Latest News

Interactive Brokers Expands Access to Taipei Exchange

Simulated Trading Competition Experience Sharing

WinproFx Regulation: A Complete Guide to Its Licensing and Safety for Traders

Axi Review: A Data-Driven Analysis for Experienced Traders

INZO Regulation and Risk Assessment: A Data-Driven Analysis for Traders

Pepperstone CEO: “Taking Down Scam Sites Almost Every Day” Becomes “Depressing Daily Business”

The CMIA Capital Partners Scam That Cost a Remisier Almost Half a Million

Is Seaprimecapitals Regulated? A Complete Look at Its Safety and How It Works

eToro Cash ISA Launch Shakes UK Savings Market

Cleveland Fed's Hammack supports keeping rates around current 'barely restrictive' level

Currency Calculator