简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How to Read the Chaikin Volatility Oscillator on Pocket Option?

Abstract:Market volatility is quite an important factor in analysing the behaviour of security prices. The trend changes more often and more rapidly during times of higher volatility.

Market volatility is quite an important factor in analysing the behaviour of security prices. The trend changes more often and more rapidly during times of higher volatility. The changes in the prices are slower and less frequent in periods of lower volatility. These changes affect the readings of indicators as the signals may come too early or too late. This is why it is important to include the volatility factor in the calculations. And today I am going to present the Chaikin Volatility indicator.

Chaikin Volatility basics

The indicator invented by Marc Chaikin is a tool that measures volatility by analysing the gap between the low and high prices of the asset over a specific time. It is known as the Chaikin Volatility indicator (VT).

Adding the Chaikin Volatility to the Pocket Option chart

Log in to your Pocket Option account. Choose the financial instrument you are going to trade during this session. Set the chart period. Click on the Chart Analysis icon and then on the Volatility group of indicators. The Chaikin Volatility will be displayed.

Of course, you may also start typing the name of the indicator needed in the search window.

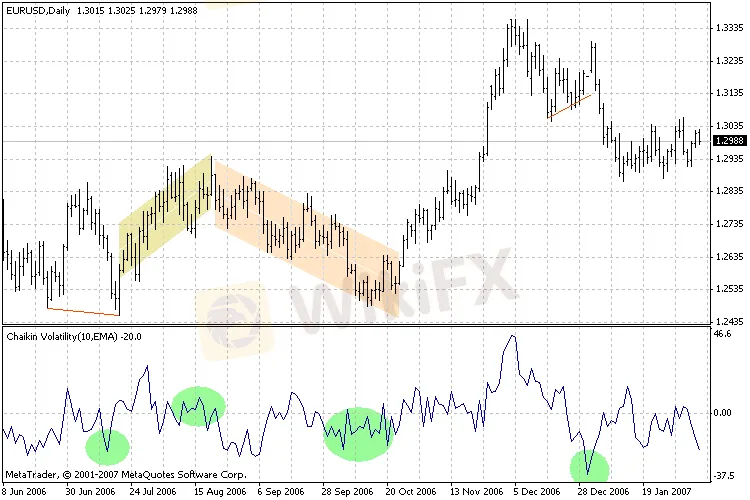

The VT will appear in the separate window beneath your price chart. It has a form of a line that oscillates around the 0 line.

How the Chaikin Volatility works

The indicator calculates the exponential moving average of the difference in the prices high and low. Then, it measures the change of this moving average over time in a percentage value.

Chaikin advises using a 10-day moving average to review volatility.

When the indicator shows low values, it means that the intraday prices range from high to low is comparatively constant. When the indicator readings show high values, the intraday prices range from high to low is pretty wide.

The situation when the price creates tops on the price chart and the volatility is increased in a short time indicates the traders get nervous. When the market tops are accompanied by decreasing volatility over a long time, it indicates a growing bull market.

Now, when the price forms bottoms and the volatility decreases over a long time, it suggests the traders do not put much interest in the market.

When volatility increases over a short period of time and there are bottoms in the market, it means traders sell in panic.

Low volatility and its decrease can be observed during the upward movement of the prices.

At the top of the uptrend, prior to a reversal of the trend, a slow increase in volatility can occur.

Higher volatility can be noted during the downward move.

Near the bottom of the downtrend, a short time volatility increase can be seen.

Final words

The Chaikin Volatility indicator measures volatility. The author recommends using a 10-day moving average in calculations.

Head to the Pocket Option demo account and check how the Chaikin Volatility works. This is a free practice account where you can check every new indicator or trading technique. It is supplied with virtual cash that you can power up any time you want. You do not lose your own money even in case of a failing transaction. Train your skills before moving to the real account.

Below, you will find the comments section. Share your thoughts about the Chaikin Volatility indicator with us. I would be glad to hear from you.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Related broker

Read more

Maven Trading Review: Traders Flag Funding Rule Issues, Stop-Loss Glitches & Wide Spreads

Are you facing funding issues with Maven Trading, a UK-based prop trading firm? Do you find Mavin trading rules concerning stop-loss and other aspects strange and loss-making? Does the funding program access come with higher spreads? Does the trading data offered on the Maven Trading login differ from what’s available on the popular TradingView platform? These are some specific issues concerning traders at Maven Trading. Upset by these untoward financial incidents, some traders shared complaints while sharing the Maven Trading Review. We have shared some of their complaints in this article. Take a look.

BTSE Review: Ponzi Scam, KYC Verification Hassles & Account Blocks Hit Traders Hard

Have you lost your capital with BTSE’s Ponzi scam? Did the forex broker onboard you by promising no KYC verification on both deposits and withdrawals, only to be proven wrong in real time? Have you been facing account blocks by the Virgin Islands-based forex broker? These complaints have become usual with traders at BTSE Exchange. In this BTSE review article, we have shared some of these complaints for you to look at. Read on!

Inzo Broker Review 2025: Is It Legit or a High-Risk Gamble?

When you ask, "Is inzo broker legit?" you want a clear, straight answer before putting your money at risk. The truth about Inzo Broker is complicated. Finding out if it's legitimate means looking carefully at its rules, trading setup, and most importantly, the real experiences of traders who have used it. The broker shows a mixed picture - it has official paperwork from an offshore regulator, but it also has many user warnings about how it operates. This review gives you a fair and fact-based investigation. We will break down all the information we can find, from company records to serious user complaints, so you can make your own clear decision.

INZO Broker No Deposit Bonus: A 2025 Deep Dive into Its Offers and Risks

Traders looking for an "inzo broker no deposit bonus" should understand an important difference. While this term is popular, our research shows that the broker's current promotions focus on a $30 welcome bonus and a 30% deposit bonus, rather than a true no-deposit offer. A no-deposit bonus usually gives trading funds without requiring any capital from the client first. In contrast, welcome and deposit bonuses often have rules tied to funding an account or meeting specific trading amounts before profits can be taken out. This article gives a complete, balanced look at INZO's bonus structure, how it operates, and the major risks shown by real trader experiences. Read on!

WikiFX Broker

Latest News

Forex Expert Recruitment Event – Sharing Insights, Building Rewards

Admirals Cancels UAE License as Part of Global Restructuring

Moomoo Singapore Opens Investor Boutiques to Strengthen Community

OmegaPro Review: Traders Flood Comment Sections with Withdrawal Denials & Scam Complaints

An Unbiased Review of INZO Broker for Indian Traders: What You Must Know

BotBro’s “30% Return” Scheme Raises New Red Flags Amid Ongoing Fraud Allegations

The 5%ers Review: Is it a Scam or Legit? Find Out from These Trader Comments

WikiEXPO Dubai 2025 Concludes Successfully — Shaping a Transparent, Innovative Future

2 Malaysians Arrested in $1 Million Gold Scam Impersonating Singapore Officials

Is FXPesa Regulated? Real User Reviews & Regulation Check

Currency Calculator